The Payments Setup Study Guide provides documentation and videos for setting up Online Payments. Topics include adding bank accounts, managing district level and school level settings, creating fund accounts for district or school level payments, understanding how parents and students make payments, and reviewing payment transactions in the Payments Reporter tool.

Online Payments Setup

This section shows how to set up payment vendor information, bank accounts, fund accounts, and district and school settings.

Vendor Information

The Vendor Information editor is used to identify your district's credentials with the payment vendor and determine which payment methods your district accepts.

Tool Search: Payments Setup

The Vendor Information editor is used to identify your district's credentials and determine which payment methods your district accepts.

| What can I do? | What do I need to know? |

|---|---|

Vendor Information Panel

Vendor Information Panel

Important Information about this Tool

- Before you can add Vendor Information, you must have your Merchant ID from your payment platform vendor.

- Vendor Information is established at the district level. That means you must select All Schools and All calendars in the Campus toolbar to use the Vendor Information tool.

Add District Credentials

- Select All Schools in the School dropdown list.

- Select your payment platform in the Payment Vendor dropdown list.

- Enter the Merchant Account ID for your district.

This ID is provided by the payment vendor.

- Click the Save button.

Result

Vendor Information is saved and visible on the Online Payments Setup screen.

New Payment Processor

Onboarding with Campus Payments is done in the Vendor Information section of Payments Setup. This video demonstrates the process for public school districts.

Onboarding with Campus Payments is done in the Vendor Information section of Payments Setup. This video demonstrates the process for private or parochial schools.

Previous Payment Processor

This video shows how to set up the online payment credentials with the payment vendor, and choose which payment methods should appear on Campus applications.

Bank Accounts

The Bank Accounts area allows you to establish which bank accounts are available for district or school use. This information is crucial for informing the payment vendor and Campus Payments which transactions apply to which bank account.

Tool Search: Payments Setup

The Bank Accounts area allows you to establish which bank accounts are available for district or school use. This information is crucial for informing the payment vendor and Campus Payments which transactions apply to which bank account.

To further enhance security, in order to add or make changes to bank accounts, you may be prompted to have two-factor authentication or single sign-on enabled. Supportive Bank Account documentation (a voided check, bank statement or a bank letter) is also needed for validation in order for disbursements to process. Once a bank account change is made, a Campus Support case should be opened to provide the necessary documentation.

To learn more about enabling two-factor authentication, review Enabling Device-Based Two-Factor Authentication and Two-Factor Authentication Options.

| What can I do? | What do I need to know? |

|---|---|

Important Information about this Tool

- If a school is not assigned as the Account Owner for any bank accounts, transactions for that school are deposited into the District bank accounts.

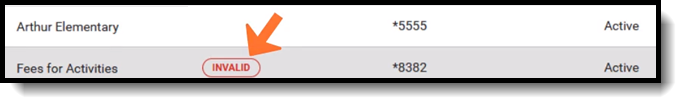

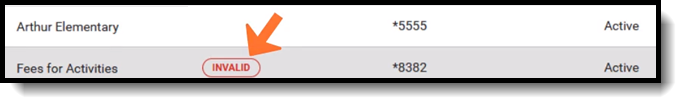

- When adding a new Bank Account (not a Bank Account Nickname), the Bank Account goes through a validation process when the first deposit is made to that bank. If the deposit is successful, the Bank Account is validated and all deposits going forward are processed normally. If the first deposit fails, Campus labels the bank Invalid and sends a Process Alert with the subject "New Bank Account Invalid - ACTION NEEDED." Clicking on the Process Alert will take you to the Payments Setup tool where you can edit the invalid Bank Account. After you edit the Bank Account, the the Bank Account goes through the validation process again.

- You cannot delete a Bank Account if transactions have already occurred; however, you can inactivate the Bank Account.

- Once a Bank Account is made inactive, it cannot be made active again.

Add a Bank Account

- Expand the Bank Accounts area by clicking the Bank Accounts header.

- Click the New button.

Result

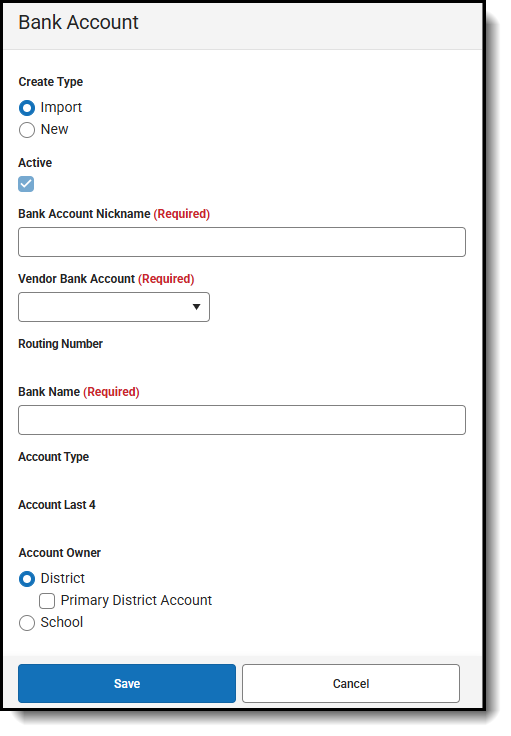

The Bank Account Panel displays. - Select the Create Type.

-

Use the information in the Field Descriptions area to complete all of the fields.

- Click the Save button.

Result

The Bank Account is saved and visible on the Online Payments Setup screen.

Delete a Bank Account

- Expand the Bank Accounts area by clicking the Bank Accounts header.

- Select the Bank Account you want to delete.

Result

The Bank Account Panel displays. - Click the Delete button.

Result

A confirmation message displays. - Click OK.

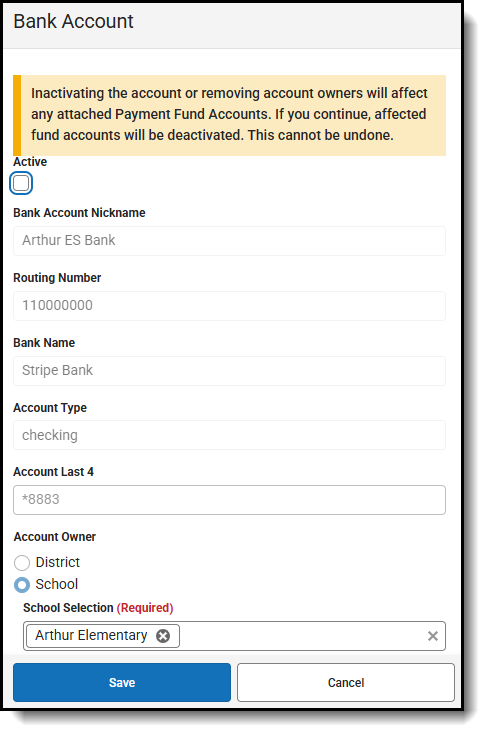

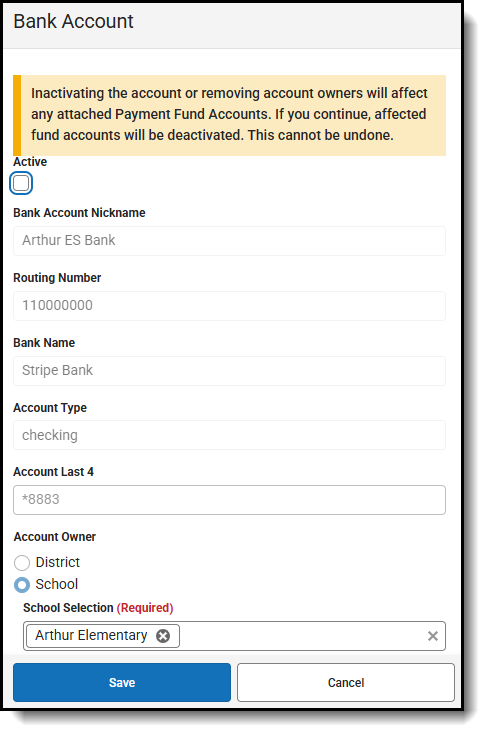

Inactivate a Bank Account

CAUTION

When a Bank Account is made inactive, Campus also deactivates all Fund Accounts associated with the Bank Account.

This action cannot be undone. Once a Bank Account is inactive, it cannot be made active again.

The payments platform may still need to deposit money to your Bank Account if there are transactions that have not completed. If you have closed your account with your financial institution, future disbursements from the payments platform to the inactive Bank Account will fail.

If you are creating new Bank Accounts in Campus, first attach your Fund Account IDs to the new Bank Account in Campus. Then you must wait until all payment transactions are deposited into the old Bank Account. Once all deposits for the old Bank Account are complete, you can inactivate the old Bank Account in Campus.

- Expand the Bank Accounts area by clicking the Bank Accounts header.

- Select the Bank Account you want to deactivate.

Result

The Bank Account panel displays. - Clear the Active checkbox.

- Click the Save button.

Result

The Bank Account is saved and visible on the Online Payments Setup screen. All Fund Accounts still associated with the Bank Account are also deactivated.

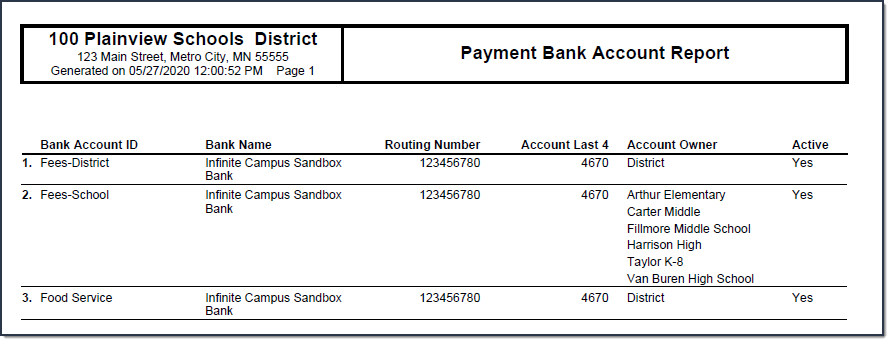

Print the Payment Bank Account Report

The Payment Bank Account Report provides comprehensive information about all of the banks you have set up in the district. This report is only available when All Schools is selected in the Campus toolbar.

To print the PDF report, click the Print All button.

Example Payment Bank Account Report

Example Payment Bank Account Report

Field Descriptions

Bank Account Panel

| Field | Description |

|---|---|

| Create Type | Select Import if you want to use a bank account that is already set up in the payment platform. When you select this option, Campus automatically provides the Routing Number, Bank Name, and account information.

Select New if this is the first time you are entering this bank account's information. |

| Active | Active bank accounts are available to send and receive transactions. When the Bank Account is active, it can be associated with a Fund Account. Inactive bank accounts are not currently in use. CAUTION Once a Bank Account is made inactive, it cannot be made active again. When you inactivate a Bank Account, Campus also deactivates all Fund Accounts associated with the Bank Account. |

| Bank Account Nickname | The Bank Account Nickname is the unique district-defined name used to distinguish different accounts in Campus. Users are encouraged to create account names which describe the bank account's owner, location, or department; e.g., District, Elementary School, Food Service, etc. |

| Vendor Bank Account | This dropdown list provides a comprehensive list of Bank Accounts set up with the payment vendor and only displays when you choose the Create Type option Import.

Vendor Bank Accounts are tied to your Merchant Account ID. If the Vendor Bank Account dropdown list is empty, verify your Merchant Account ID is entered correctly in the Vendor Information area. |

| Routing Number | The bank's routing number. If you imported a bank account that was already set up, this field is read-only. |

| Bank Name | The Bank Name established with the payment vendor. If you imported a bank account that was already set up, this field is read-only. |

| Account Type | Indicates whether the account is a checking or savings account. If you imported a bank account that was already set up, this field is read-only. |

| Account Last 4 | Import Only The last 4 digits of the bank account. This field is read-only. |

| Account Number | New Only The complete bank account number. |

| Account Owner |

|

Bank Accounts used at a district or school level are created and maintained in the Bank Accounts section of Payments Setup.

New Payment Processor

Previous Payment Processor

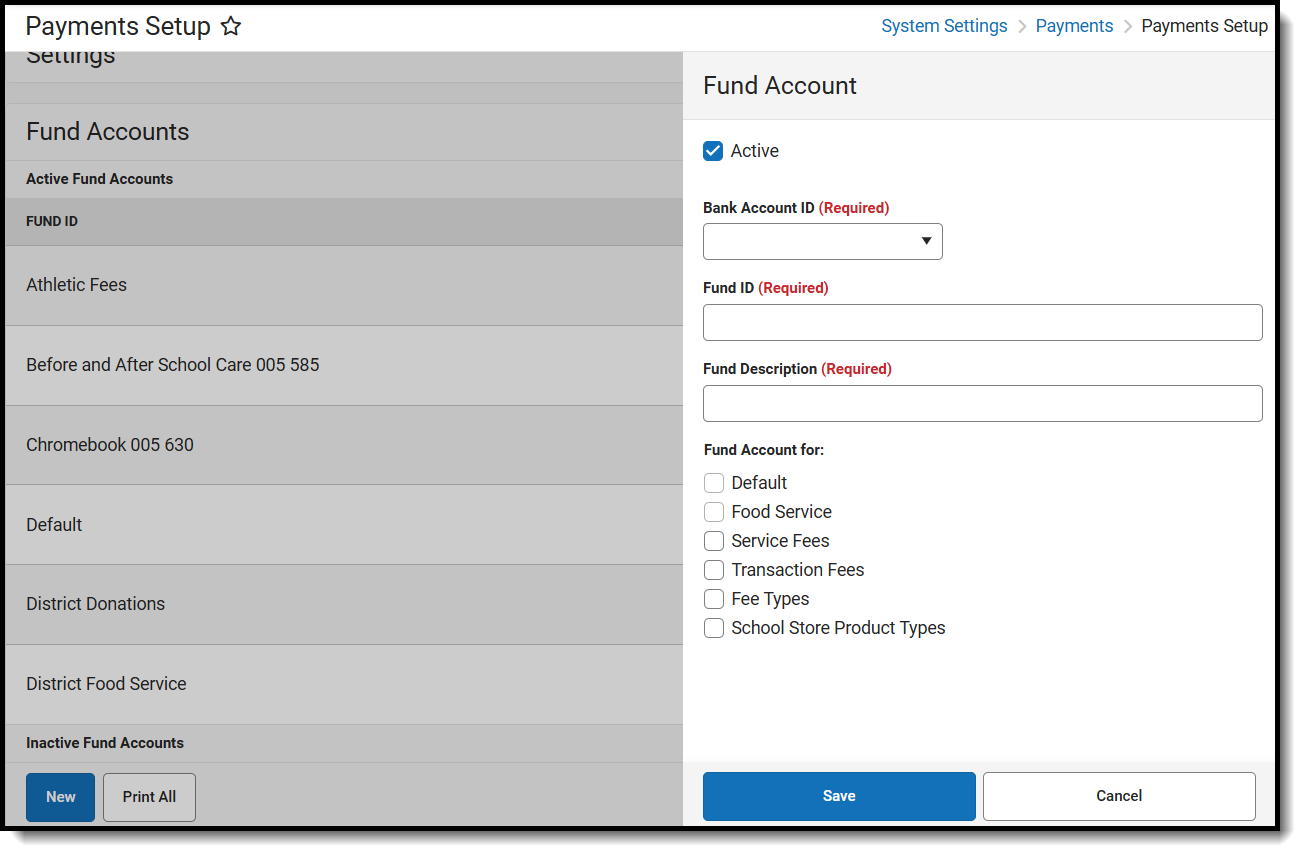

Fund Accounts

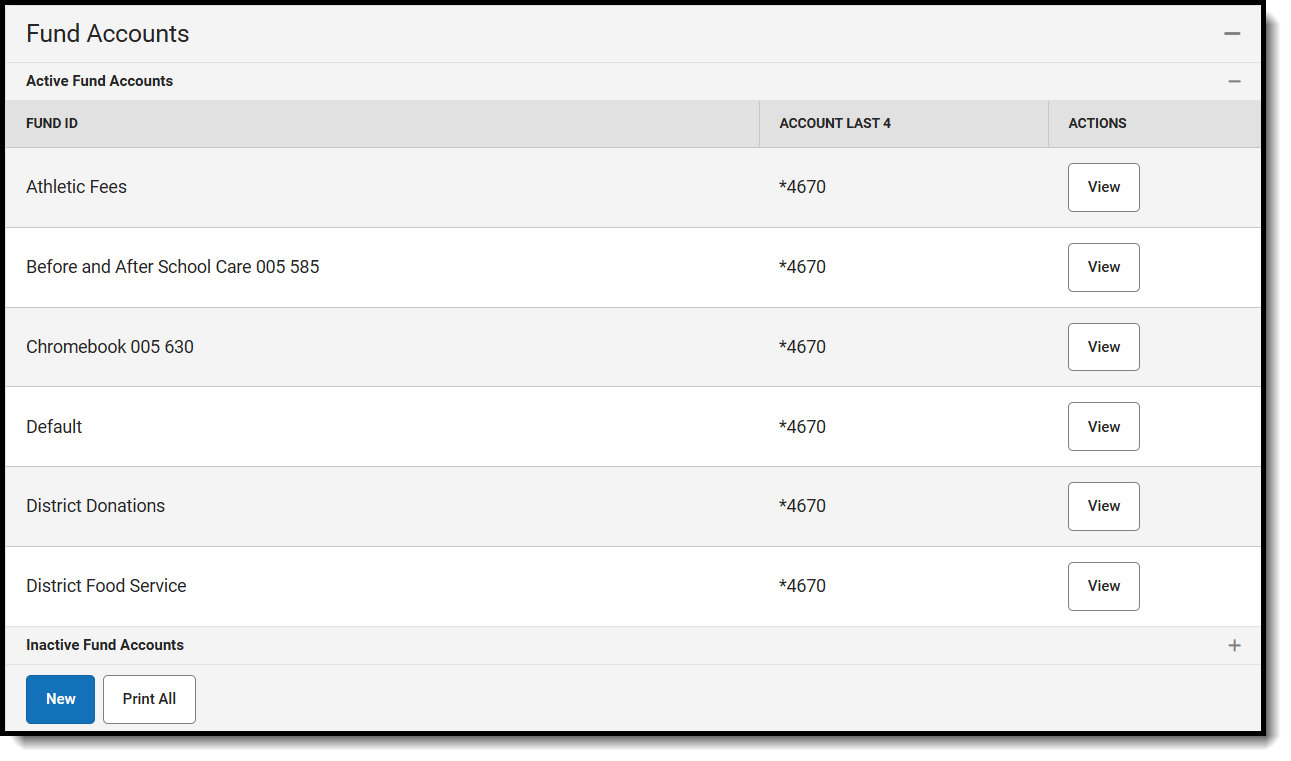

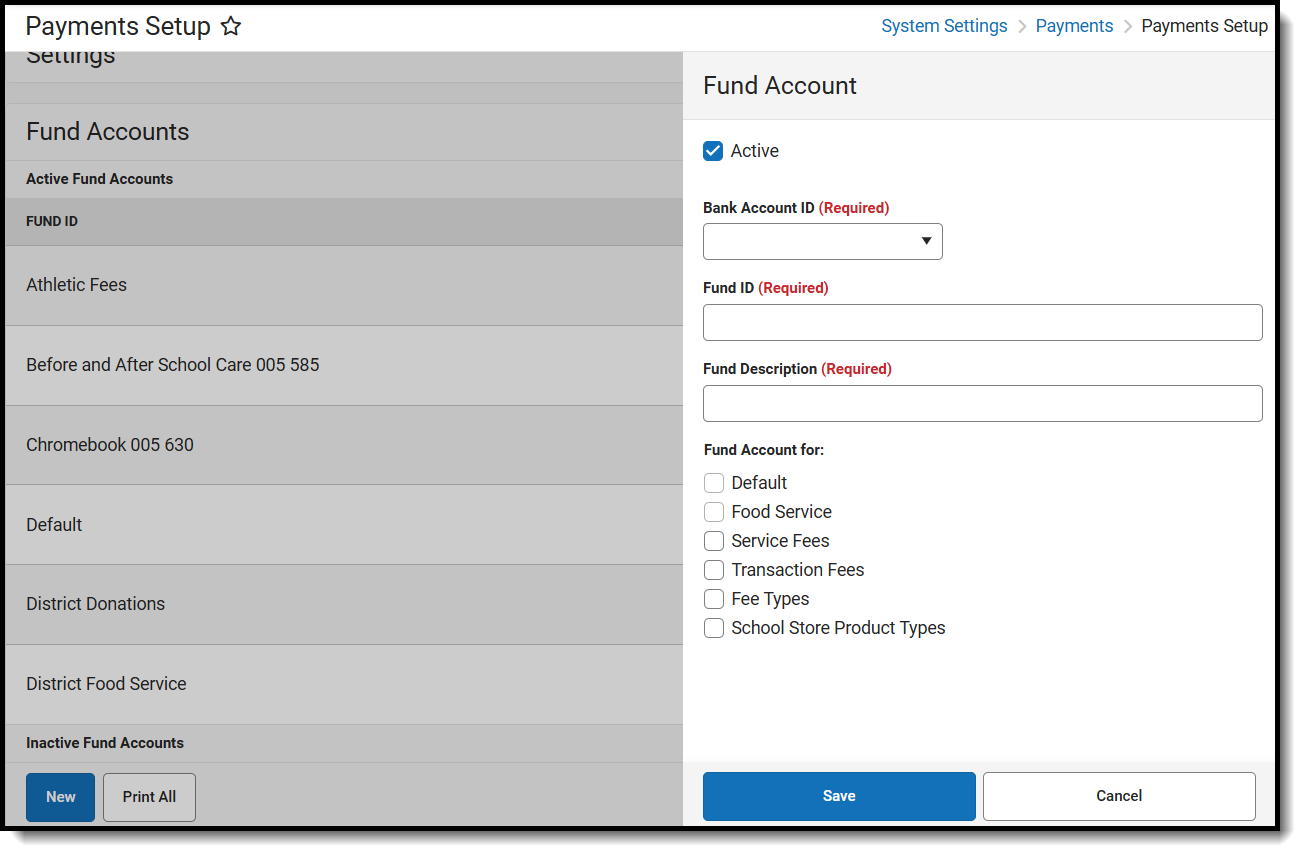

Fund Accounts identify which bank account is used for each fee and/or service and they can be set up for the district or a school. Fund accounts are used with School Store and Activity Registration.

Tool Search: Payments Setup

Fund Accounts identify which bank account is used for each fee and/or School Store product.

| What can I do? | What do I need to know? |

|---|---|

Example of Fund Accounts

Example of Fund AccountsImportant Information about this Tool

- Once a Fund Account is made inactive, it cannot be made active again.

- When a Bank Account is inactivated, Campus inactivates all Fund Accounts associated with the Bank Account.

- A Fund Account cannot be deleted if transactions were made using that Fund Account.

- One Bank Account can be used for multiple Fund Accounts. This feature allows your district to segregate payment categories such as Food Service or Fee/Fee Types within the same Bank Account.

- The following characters cannot be used in the Fund ID: > < * “ % + = ^ [ ]

- When you change a Fund ID name and/or Bank Account ID, Campus creates an inactive copy of the original Fund Account and names it by appending "Archived" to the original name; e.g,"FundName_Archived." Campus reporting uses "FundName_Archived" for past transactions and uses the new Fund ID name for new transactions.

Fund Account Types

| Type | Description |

|---|---|

| Default | You can set up a default Fund Account for the District and at each school. The default Fund Account is used when a fee or payable service is paid and a Fund Account is not set up for the fee or payable service. Campus first looks for the Fee's Fund Account then Campus looks for the school's Default Fund Account. If the school does not have a Default Fund Account, Campus uses the District's Default Fund Account. |

| Food Service | All food service transactions are deposited to this bank account. If your district uses Household Food Service accounts, only set up one Food Service Fund account. This allows Campus to identify the correct Fund Account when there are multiple enrollments associated with an account. |

| Service Fees | All service fees are deposited to this bank account. |

| Transaction Fees | All transaction fees are deposited to this bank account. |

| Fee Types | This option allows you to indicate which fees and services are deposited into the selected bank account. A list of Fee Types display below the Fee Types checkbox when it is marked. Fee Types are created and modified in the Fee Type dictionary in the Core Attribute Dictionary. Fee Types are assigned to Fees and Fund Accounts. Once a Fee Type is selected for a Fund Account, you cannot select the same Fee Type for a second Fund Account at the same school.

Optional Fees associated with a student's enrollment in a future calendar do not display in Campus Parent or Campus Student. |

| School Store Product Types | This option allows you to indicate which Fund Accounts are used for items purchased in the School Store. |

Add a Fund Account

For District Fund Accounts, select All Schools in the School dropdown list.

- Click the New button.

Result

The Fund Account panel displays and the Active checkbox is automatically selected.

- Select the Bank Account ID.

Enter a unique FUND ID to identify the Fund Account. (50 characters max)

The following characters are not permitted: > < * “ % + = ^ [ ]

FUND IDs must be unique. You cannot use the same FUND ID at different schools.

- Enter a unique Fund Description.The field only allows 120 characters and cannot include trailing spaces.

Campus automatically uses the Fund ID as the Fund Description, but you can change the Fund Description to suit your district's needs. This field is informational only and can optionally display in the Payments Reporter. - Select one of the following checkboxes:

- Default

- Food Service

- Service Fees

- Transaction Fees

- Fee Type - Also select the Fees you want to include.

- School Store Product Types - Also select the Product Types you want to include.

- Click the Save button.

Edit a Fund Account

You can change any field on the Fund Account except for the Default checkbox.

See the Important Information about This Tool topic in this tool for detailed information about editing Fund Accounts.

- Expand the Active Fund Accounts area by clicking the Active Accounts header.

- Click View for the Fund Account you want to edit. The Fund Accounts will panel display.

- Make the necessary changes then click Save.

Inactivate a Fund Account

Caution

This action cannot be undone. Once a Fund Account is inactive, it cannot be made active again.

- Expand the Fund Accounts area by clicking the Active Fund Accounts header.

- Select the Fund Account you want to inactivate. The Fund Accounts panel displays.

- Clear the Active checkbox.

- Click the Save button.

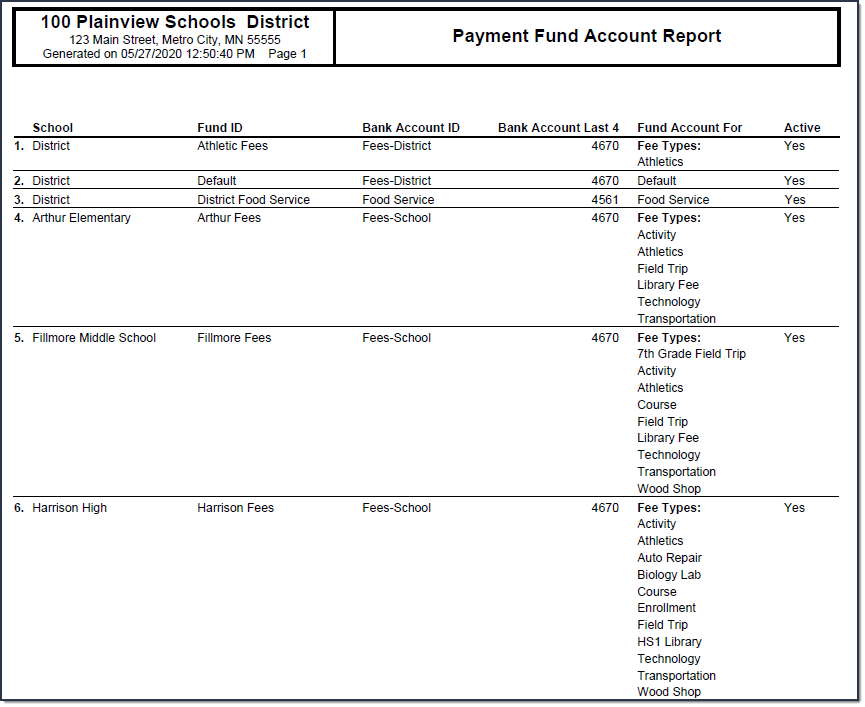

Print the Payment Fund Account Report

The Payment Fund Account Report provides comprehensive information about all of the Fund Accounts you have set up in the district or all of the Fund Accounts set up for a specific school. When All Schools is selected in the Campus toolbar, information for all schools in the district reports. Otherwise, the report is limited to the Fund Accounts set up for the specific school selected in the toolbar.

To print the PDF report, click the Print All button.

The payments for specific fees and/or services can be assigned to particular fund accounts using the Fund Accounts tool.

Settings

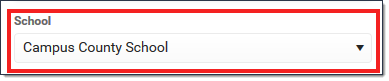

There are two sets of settings: 1) District Settings allow you to establish payment features for the entire district. 2) Each school can set the School Portal Settings based on their needs.

Tool Search: Payments Setup

The Settings area is used to establish payment features for the entire district and for individual schools.

| What can I do? | What do I need to know? |

|---|---|

Important Information about this Tool

The Settings for the District are different than the settings for individual schools.

To manage Settings for the district, select All Schools in the Campus toolbar.

To manage Settings for an individual school, select the school in the Campus toolbar.

- Service Fees apply to ALL Credit/Debit Card, Checking, and Savings payments.

Manage District Settings

District Settings allow you to establish payment features for the entire district. All Schools must be selected.

| Setting | Description |

|---|---|

| Accepted Payment Methods | Select the checkbox next to each payment method you want to accept. When you remove an Accepted Payment Method by clearing the checkbox next to it, Infinite Campus does NOT delete the registered payment information from the portal user or prevent the user from using that Payment Method. Clearing the checkbox prevents users from registering payment information for that Payment Method. |

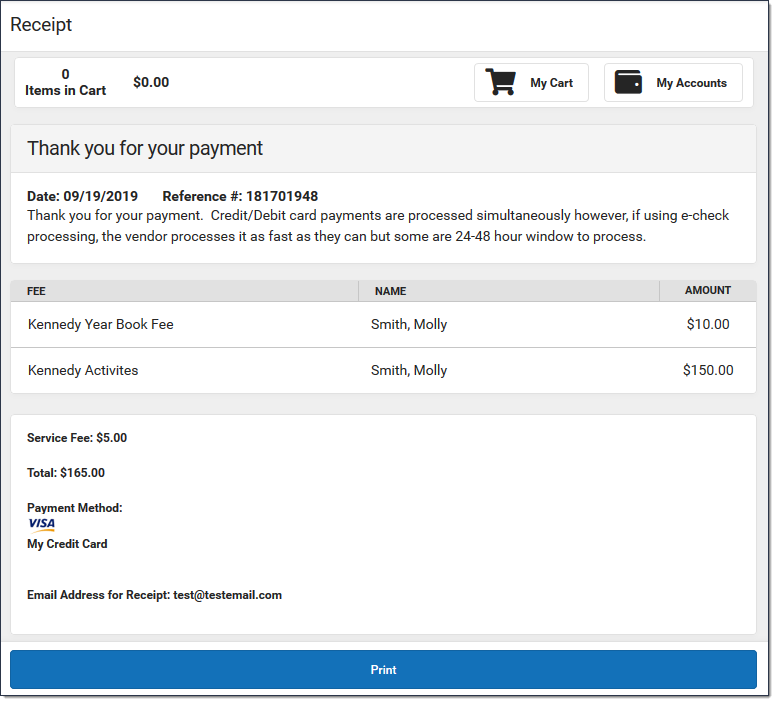

| Email Receipts | When this checkbox is marked, a receipt of payment is sent to the email address the user enters. |

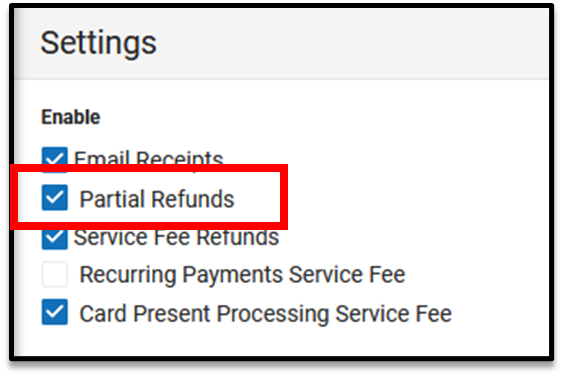

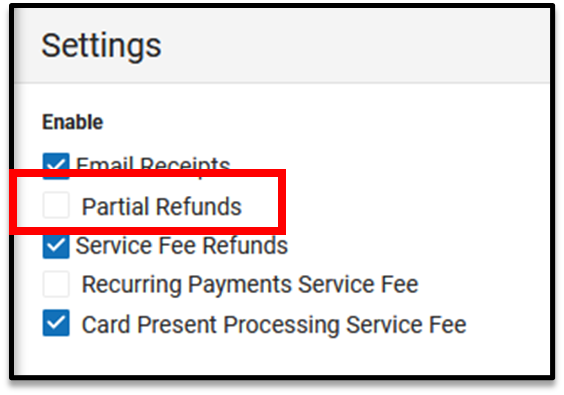

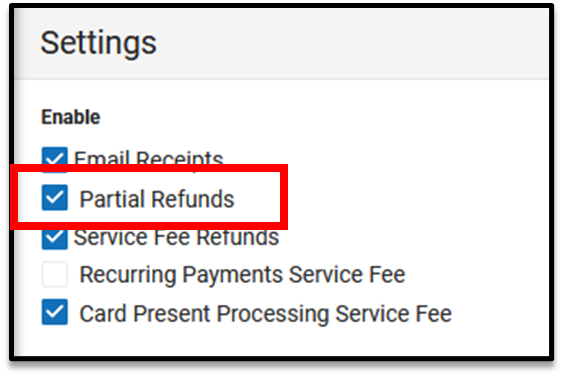

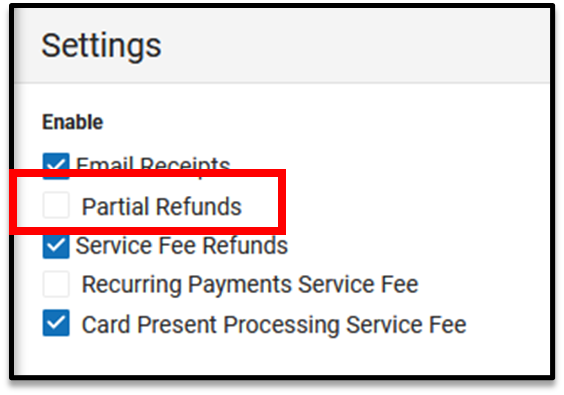

| Partial Refunds | When this checkbox is marked, individual lines on a transaction can be refunded. |

| Service Fee Refunds | When this checkbox is marked, service fees are also refunded when a refund is issued to a parent or student. If your district chooses not to refund Service Fees, the original transaction is assigned the "Returned" Transaction Status but does not have a Return Void offsetting transaction in the Payments Reporter. |

| Recurring Payments Service Fee | Users are charged a Service Fee on recurring payments when this checkbox is marked. |

| Card Present Processing Service Fee | When this checkbox is marked, users are charged a Service Fee when they make credit or debit card payments in the school office with a physical card. |

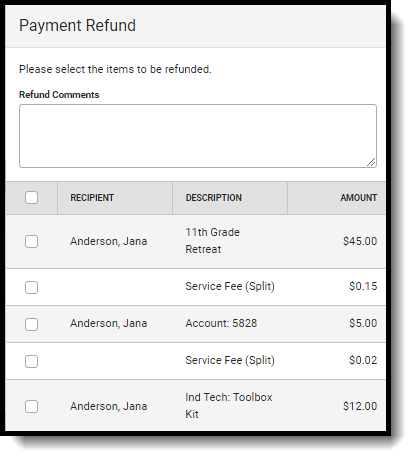

| Split Transaction and Service Fees | When you select the checkbox, the processing of Transaction and Service Fees changes. By default (when unchecked), all the Transaction and Service Fees are processed out of the District default account, unless there is a specific Fund Account set up for each. By enabling this checkbox, the fees will follow the Fund Accounts of the purchased items, instead of using the default Fund Accounts. |

| Card Service Fee | This amount indicates the amount the user will be charged for each credit card or debit card payment they make. The service fee may cover the costs, if any, that the district must pay to the payment vendor or other processing fees that may occur. Select Fixed Amount OR Fixed Percentage. Based on the option you choose, you may enter a specific amount or a percentage. In Campus Parent/Student, the Service Fee is always presented to the payer as a flat amount. If you don't want to charge a service fee, leave the amount at zero. If you DO charge a service fee, the Card Service Fee is charged to ALL Credit/Debit Card payments. |

| E-Check Service Fee | This amount indicates the amount the user will be charged for each e-check payment they make. The service fee may cover the costs, if any, that the district must pay to the payment vendor or other processing fees that may occur. Select Fixed Amount OR Fixed Percentage. Based on the option you choose, you may enter a specific amount or a percentage. In Campus Parent/Student, the Service Fee is always presented to the payer as a flat amount. If you don't want to charge a service fee, leave the amount at zero. If you DO charge a service fee, the E-Check Service Fee is charged to ALL e-check payments. |

| Minimum Payment Amount | This amount indicates the lowest dollar amount that can be paid. The minimum payment must be greater than $0. |

| Payment Comments | Enter any information regarding online payments. This message appears when users check out using My Cart and is limited to 2500 characters. Districts can include the following items in this area:

|

| Receipt Comments | Enter any information regarding online payments. This message appears on the payment receipt. Limit 2500 characters. |

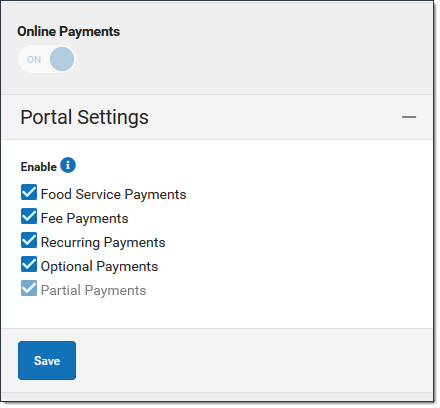

Manage School Portal Settings

The following settings can be enabled and disabled for individual schools by marking the checkbox to enable the setting or clearing the checkbox to disable the setting.

These settings do NOT affect Employee Self Service.

| Setting | Description |

|---|---|

| Food Service Payments | When this checkbox is marked, users can add money to Food Service accounts. For this feature to work in Campus Parent/Campus Student

|

| Fee Payments | When this checkbox is marked, users can pay Fees. |

| Recurring Payments | Using recurring payments, users can pay installments for a fee, pay for recurring services from the district, or automatically add money to a Food Service account when it reaches a low balance. |

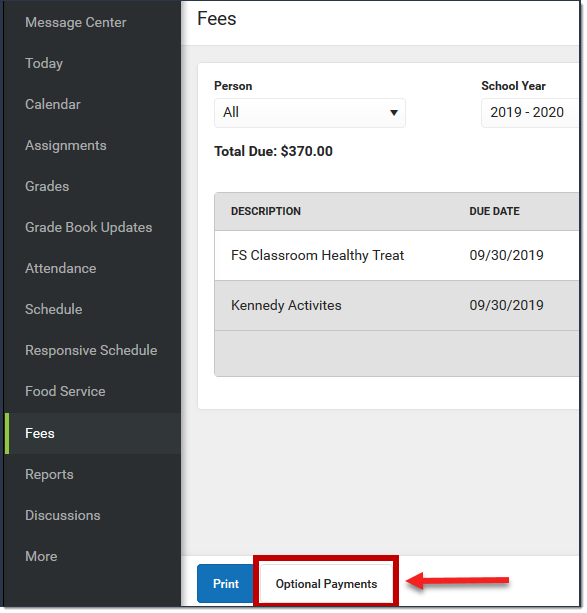

| Optional Payments | When this checkbox is marked, users can assign fees to themselves or members of their household and make payments towards those fees. This also enables the Optional checkbox on the Fees editor. Using optional payments requires school staff to mark which fees can be paid this way. See the Fees article for information. |

| Partial Payments | Partial Payments are automatically enabled if you select Recurring Payments. When this option is enabled, Campus Parent and Campus Student users can partially pay a fee. |

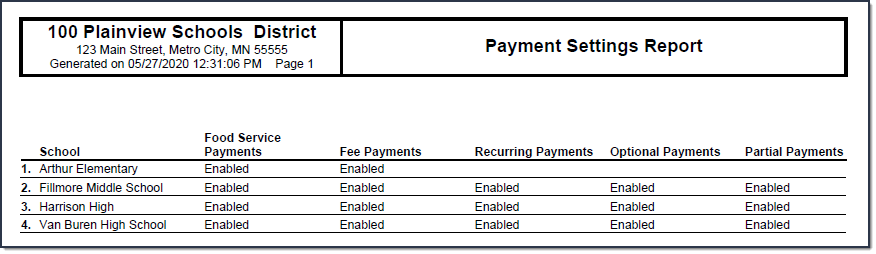

Print the Payment Settings Report

The Payment Settings Report provides comprehensive information about all of the settings for all schools in the district. This report is only available when All Schools is selected in the Campus toolbar.

To print the PDF report, click the Print All button.

Staff can determine which options to use within Campus' Online Payments module using the Settings tool.

Previous Versions

Settings (Payments Setup) - Video [.2343 - .2403]

Payments Notifications

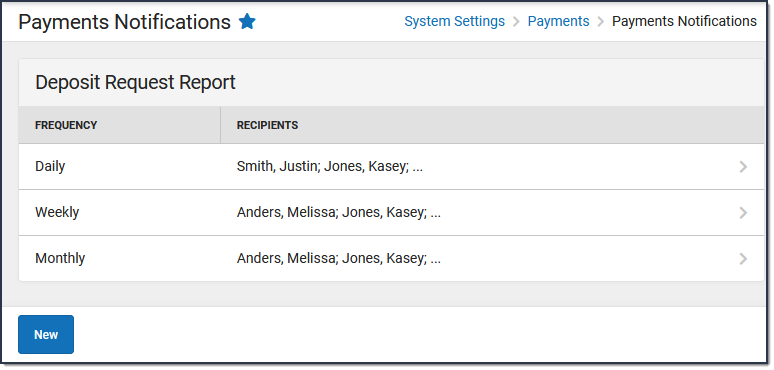

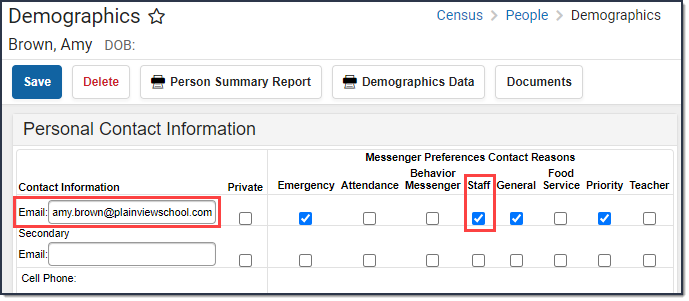

The Payments Notifications tool allows staff to have the Deposit Request Report emailed to them as a PDF document.

Tool Search: Payments Notifications

Districts can set up a Payments Notification for the Deposit Request Report. The notification is an email that includes a PDF version of the Deposit Request Report. Only users assigned tool rights to the Deposit Request Report may be assigned to receive this email.

| What can I do? | What do I need to know? |

|---|---|

Important Information About this Tool

- Campus Messenger must be enabled.

- In the Email Settings tool, the required fields must be filled in and the Allow Email Attachments checkbox must be marked.

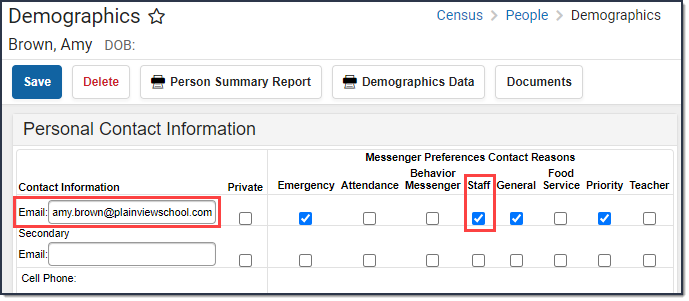

- To receive a notification, Recipients must

- be assigned tool rights to the Deposit Report,

- have the Staff checkbox marked, and

- an Email address entered on the Demographics tool.

If a recipient is added to a notification but later does not meet all three requirements, a red exclamation displays on the Payments Notification screen and on the notification panel.

![]()

Troubleshooting

The Sent Message Log, Mailgun Message Log, and Recipient Log allow you to see when messages were sent and to whom they were sent. Use these tools to troubleshoot Payments Notifications issues.

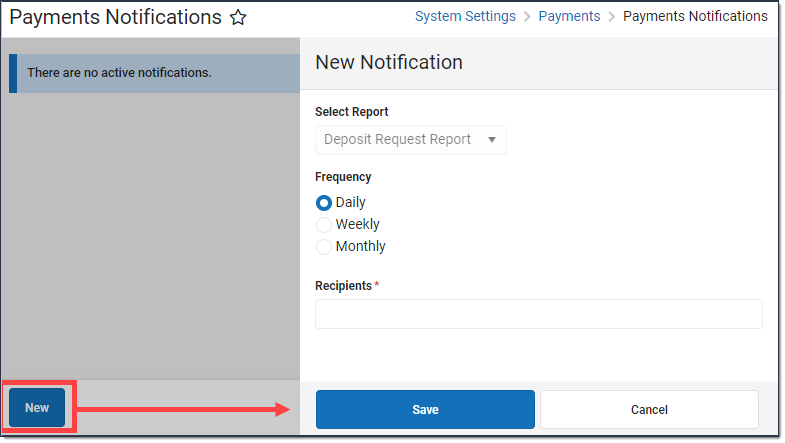

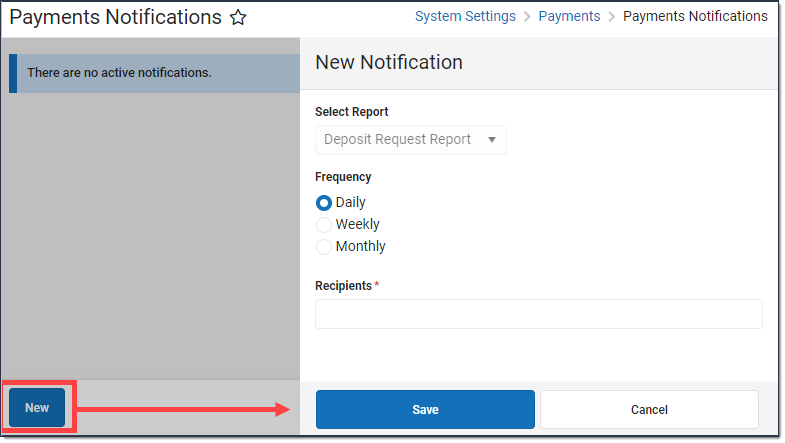

Add a Notification

- Click the New button.

Result: The New Notification panel displays.

- Select the Frequency for sending the notification.

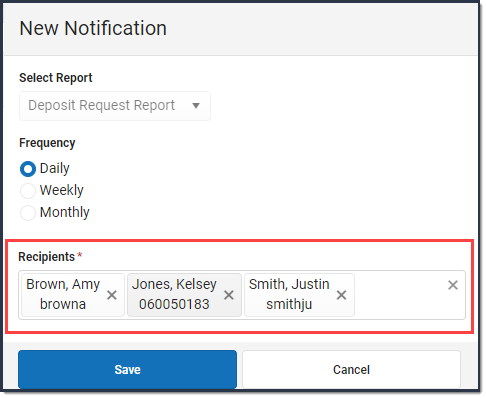

Frequency Description Daily The daily email is sent on Monday, Tuesday, Wednesday, Thursday, and Friday mornings. Weekly The weekly email is sent on Mondays. After setting up this notification, Campus will begin emailing the selected recipients the following Monday. Monthly The monthly email is sent on the first day of the month. After setting up this notification, Campus will begin emailing the selected recipients on the first day of the following month. - Select the Recipients to whom the notification should be sent.

- Click the Save button.

Result: The new notification is saved and displays on the Payments Notifications tool.

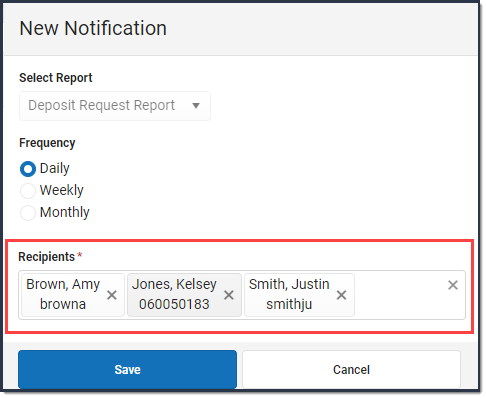

Add or Remove Recipients from a Notification

- Select the notification you want to modify.

Result: The Deposit Request Report panel displays. - Click the X next to any Recipients you want to remove or type in the field to find and add new Recipients.

- Click the Save button.

Result: Changes are applied immediately and affect the next notification.

Delete a Notification

- Select the notification you want to delete.

Result: The Deposit Request Report panel displays. - Click the Delete button.

Result: A confirmation message displays. - Click the Delete button on the confirmation message.

Result: Campus deletes the notification and notification messages are stopped.

The Payments Notifications tool allows staff to have the Deposit Request Report emailed to them as a PDF document.

Portal Payments Use

Learn how parents/guardians and students manage payment methods, select optional payments to pay, set up recurring payments, add money to your food service account, and view payment history.

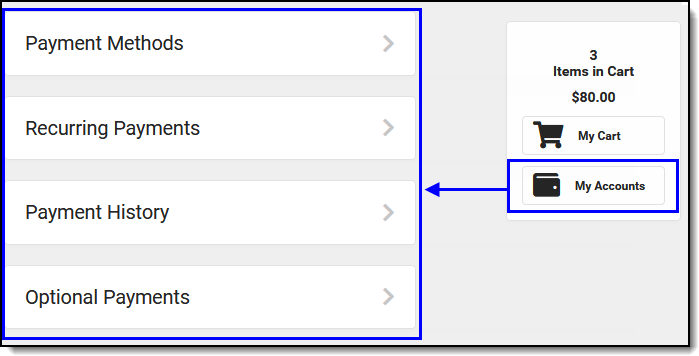

My Accounts

The My Accounts is the tool where parents/guardians and students manage payment methods, select optional payments to pay, set up recurring payments, and view payment history.

The My Accounts is the tool where you can manage payment methods, select optional payments to pay, set up recurring payments, and view your payment history.

| What can I do? |

|---|

|

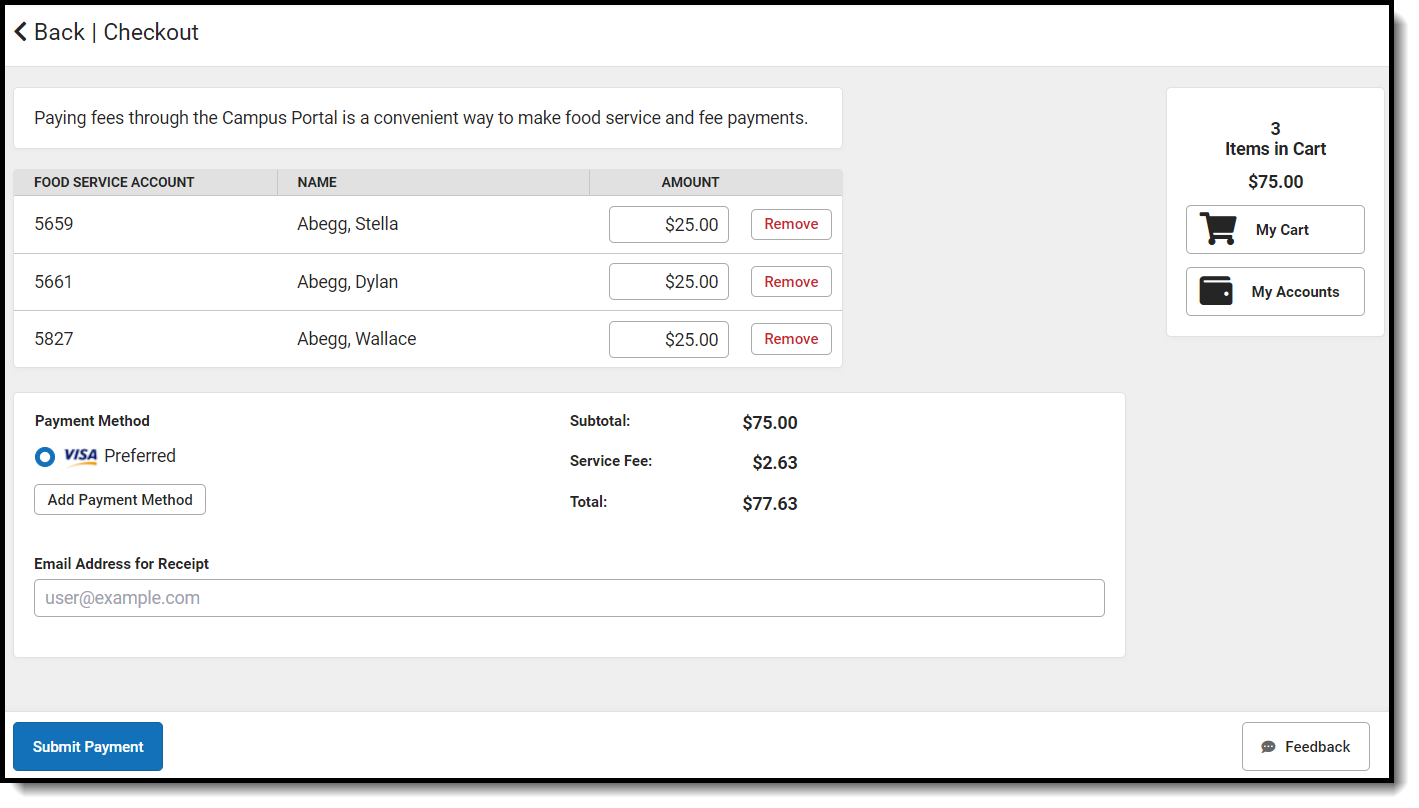

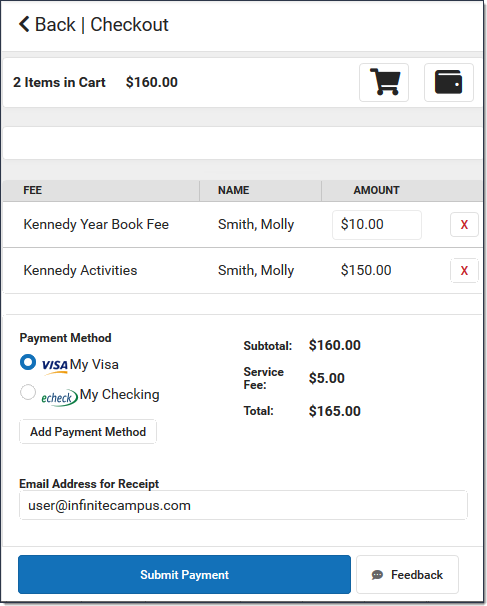

My Cart - Checkout View

My Cart is where parents/guardians and students pay fees and add money to their food service account. Items can be added to My Cart from any of the following areas: Food Service, Fees, and Optional Payments.

My Cart is where you pay fees and add money to your food service account. You can add items to My Cart from any of the following areas:

My Cart - Food Service

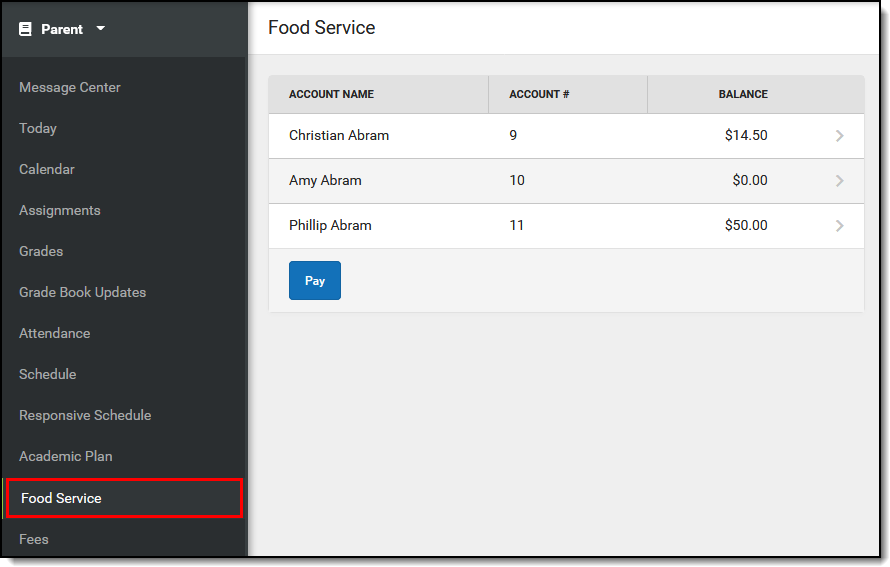

The Food Service tool allows parents/guardians and students to see what meals and food items were purchased as well as add money to their Food Service account.

The Food Service tool allows you to see what meals and food items were purchased as well as add money to your Food Service account.

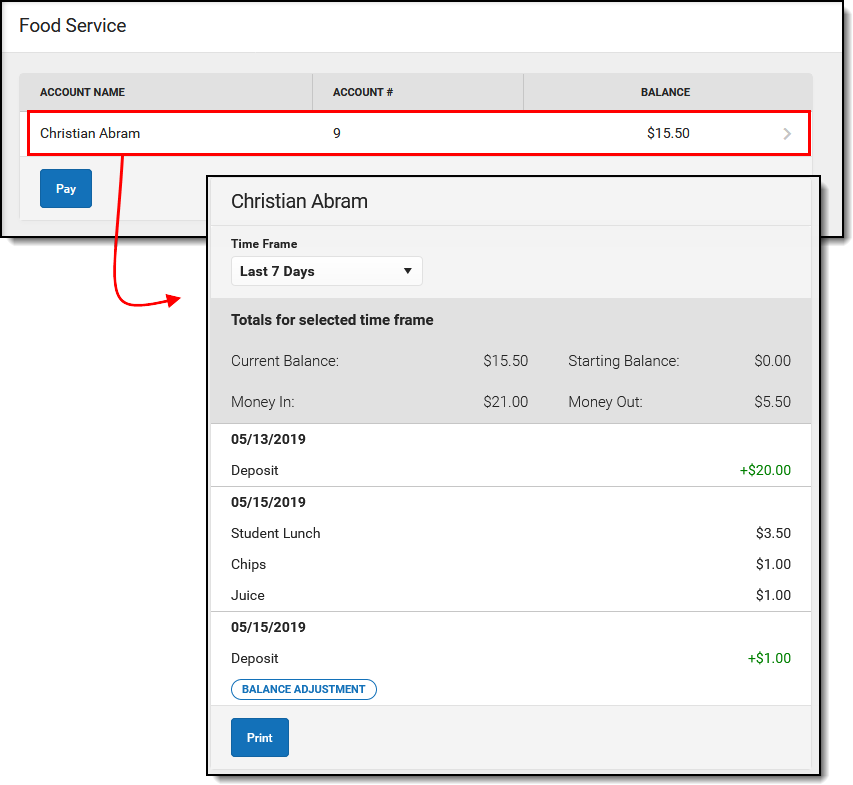

From here you can view also view

- current account balances,

- money in and money out, and

- adjustments made to your account by the school office.

The number of accounts that appear on this screen depend on whether you are a student, a parent, or a parent with access to multiple students.

The link to the Food Service tool does not display for everyone. Specific school operations and settings determine whether this link displays. Similarly, the option to add money to your Food Service account is only available if your school uses this feature.

Where do I go to view and add money to my Food Service Account?

The Food Service tool is available in the outline on the left.

How do I add money to my Food Service account?

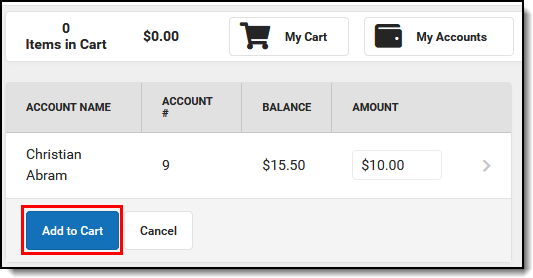

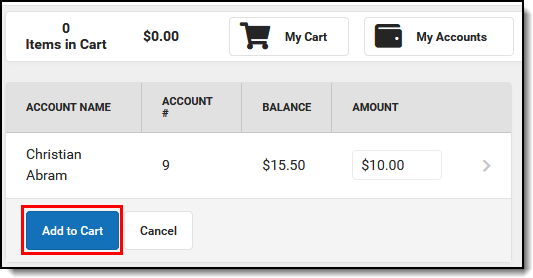

- Select Pay.

- Enter the amount you want to add in the Amount field. If a box is not available for you to enter an amount, your account may not be active and you may need to contact your school.

- Select Add to Cart.

- Select My Cart. The Checkout Screen displays.

- Select the Payment Method you want to use and enter an Email Address for Receipt (optional).

- Select Submit Payment.

How do I automatically add money to my Food Service account?

To automatically add money to your Food Service account on a monthly basis or when it reaches a low balance, use the Recurring Payments tool–this is NOT part of the Food Service tool.

Need more information?

See the Recurring Payments article for more information.How do I view what I have purchased?

To see a list of items that you have purchased, select your account name. A screen displays with all of your account's details, including any deposits or adjustments.

My Cart - Fees

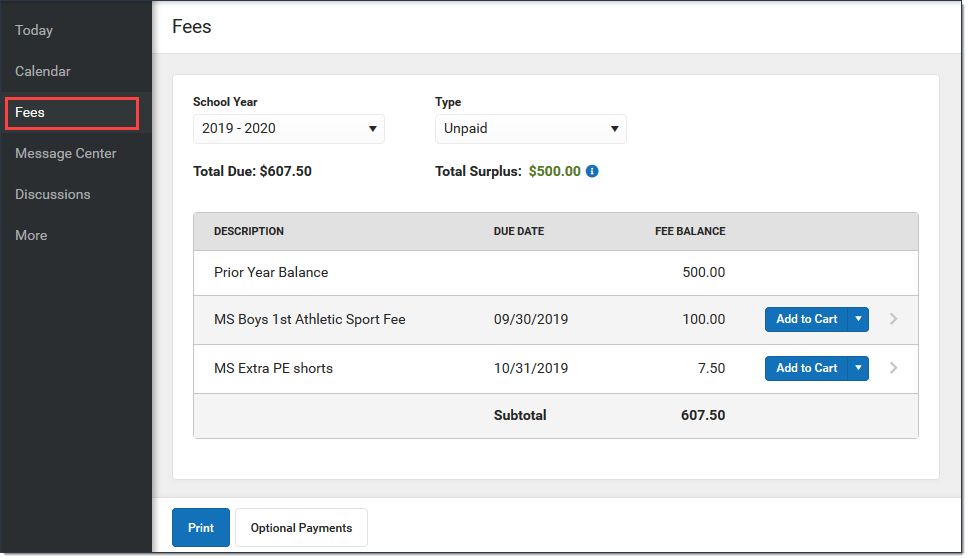

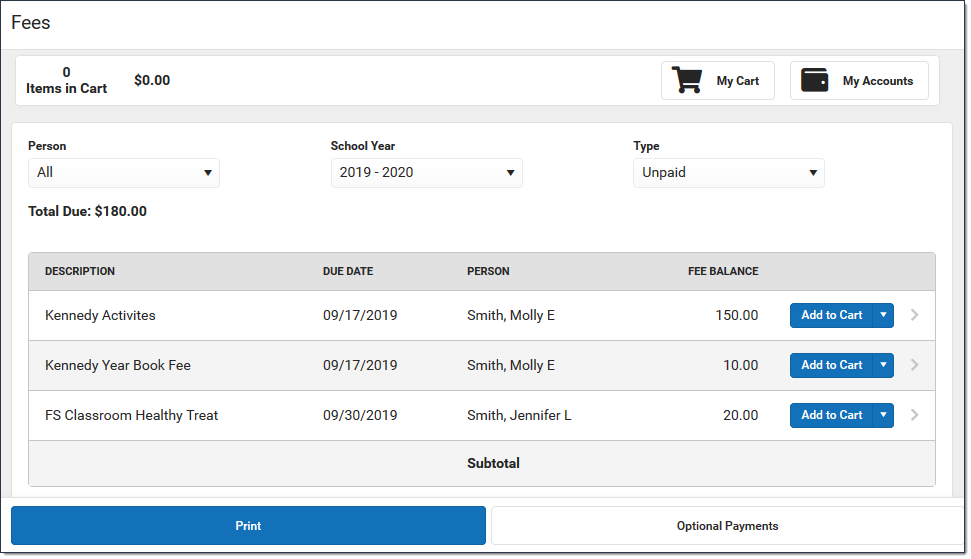

The Fees tool provides a list of all fees assigned to the parent/guardian and student. Fees may include things like a lab fee for a photography course or the cost of an athletic activity. Fees that are still owed and fees that were paid appear in this list, followed by the ongoing balance for all fees.This tool lets parents/guardians or students select fees for payment.

The Fees tool provides a list of all fees assigned to you. Fees may include things like a lab fee for a science course, a fee for a field trip or the cost of an athletic activity. Fees that are still owed and fees that were paid appear in this list, followed by the ongoing balance for all fees.

Where do I go to view and pay fees?

The Fees tool is available in the outline on the left.

How do I Pay a Fee?

- Select Fees.

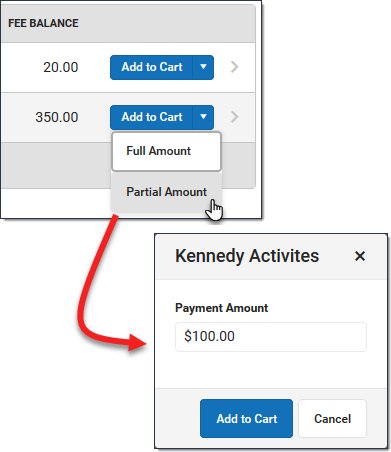

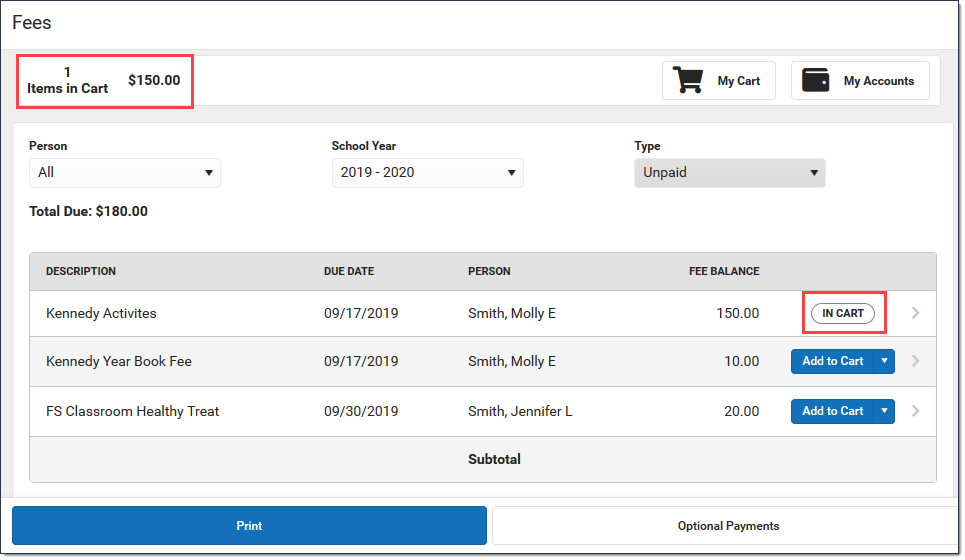

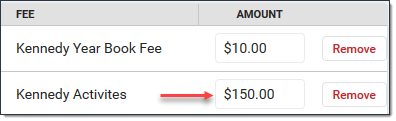

- Select Add to Cart next to the Fee you want to pay.

- Select My Cart.

- Select the Payment Method you want to use and enter an Email Address for Receipt (optional).

- Select Submit Payment.

Need more information?

See the following Pay a Fee section for more detailed information.

How do I find unpaid fees?

Select Unpaid in the Type dropdown list.

How do I pay Optional Fees?

Optional fees are fees that are not assigned to you directly. This could be things like parking stickers, donations to the school, school supplies, etc. Optional Fees are paid using the Optional Payments tool. While adding Fees to My Cart, you can click the Optional Payments button to get to the Optional Payments tool.

See the Optional Payments article for more information about that tool.

How do I find fees I already paid?

Select Paid in the Type dropdown list. Fees that are partially paid do not display when Paid is selected. Instead, select Unpaid and click the arrow next to the partially paid Fee to see the paid amount.

The Payment History tool is a good place to review all payments you have made including payments for Fees.

Pay a Fee

| Step | Action |

|---|---|

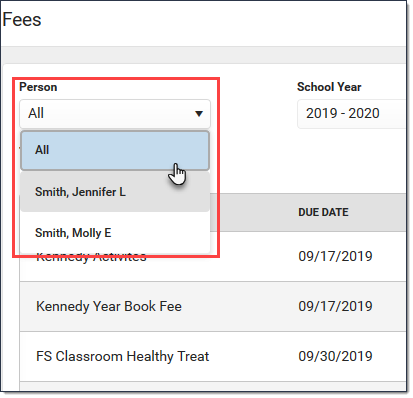

| 1 | Select Fees. Result If you are using Campus Parent and have access to multiple students, be sure to select the correct student/person in the Person dropdown list. Selecting All allows you to see Fees assigned to everyone in your household.

|

| 2 | Select Tips

Result

|

| 3 | Select Result Tip: Partial Payments If your district allows you to partially pay a fee, you can change how much you want to pay in the Amount field.

|

| 4 | Select the Payment Method you want to use and enter an Email Address for Receipt (optional). Click the Add Payment Method button if the card or account you want to use is not set up. This option allows you to enter a new Payment Method then returns you to this screen.

|

| 5 | Select Result Click the Print button to print a copy of the receipt.

|

Remove Access to Online Payments

Access to Online Payments can be removed for an individual or several household members.

An Individual

The Payments tool provides the option to remove a person's access to online payments. When this option is set, the individual does not see the Payments area on the portal.

Tool Search: Payments

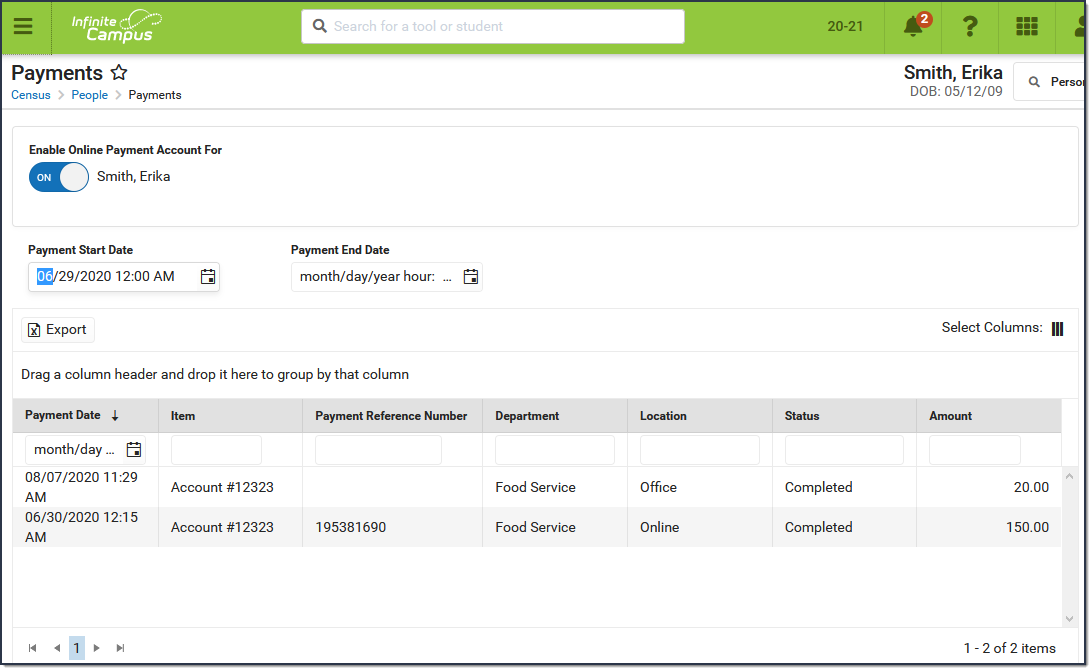

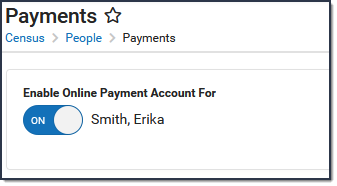

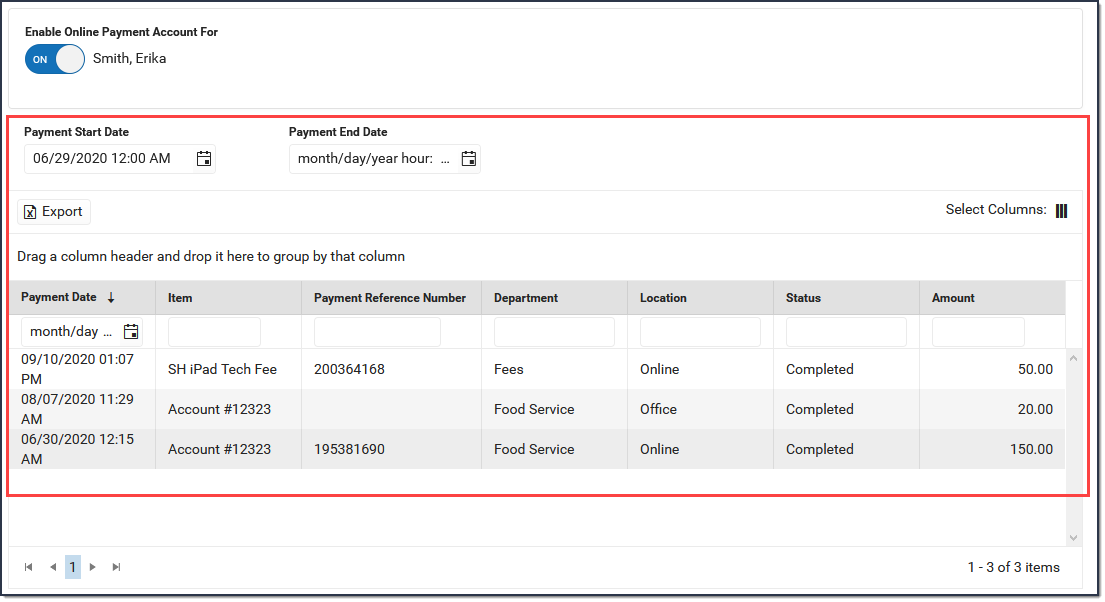

The Payments tool provides a summary of online payments, Food Service deposits, School Store purchases, and office payments made for an individual person. The Payments tool is also where you can enable or disable a person's access to online payments.

| What can I do? |

|---|

| Enable or Disable Access to Online Payments Review Payments |

Enable or Disable Access to Online Payments

- When this toggle is ON, the person can use My Cart to make payments.

- When this toggle is OFF, the person can NOT use My Cart to make payments. When you set this toggle to OFF, recurring payments set up by this person are automatically stopped.

By default, users may make payments for any Fee regardless of the calendar in which the Fee was assigned. This also means that payments can be made for students who do not have an active enrollment.

Review Payments

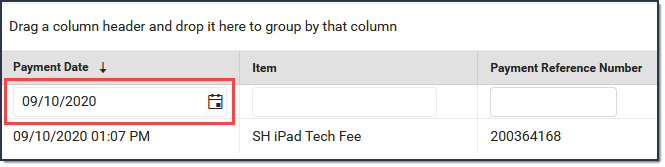

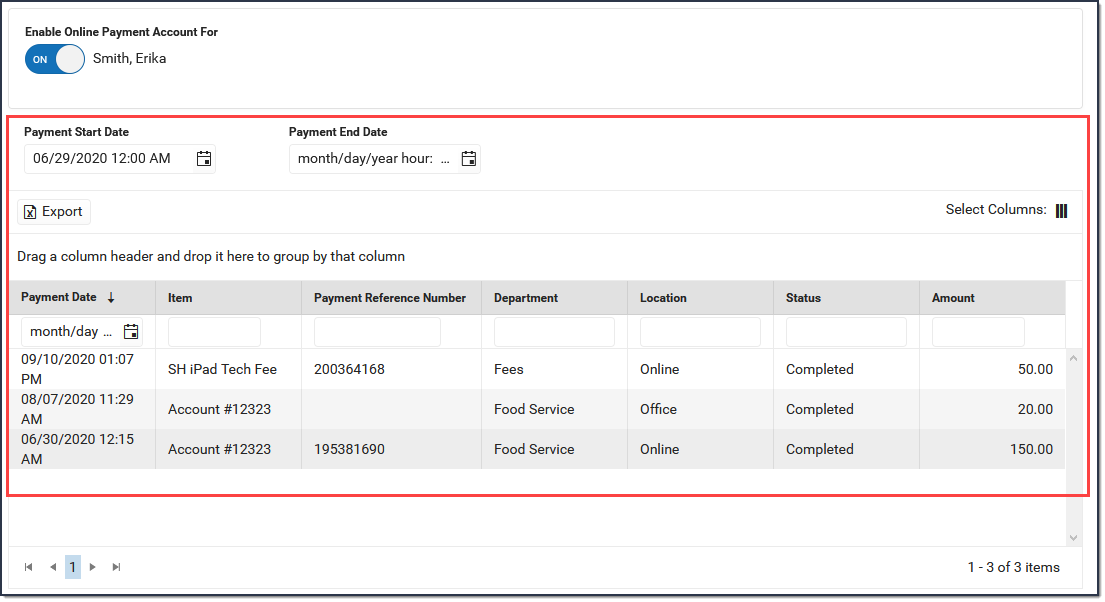

The Payments tool allows you to review details about transactions that were completed through the online payment process, a food service terminal, or in the office.

- You can sort the results by clicking a column heading. Each click changes the data in ascending or descending order.

- You can add filters to narrow the report's results. For example, you can find payments that were made on a specific date.

- The column selector allows you to choose which columns to hide or display. Click the

button and mark the checkbox next to the columns you want to display. Clear the checkbox next to columns you want to hide.

button and mark the checkbox next to the columns you want to display. Clear the checkbox next to columns you want to hide. - The Amount column is only visible if you are assigned the Show Payment Amounts tool right.

If you are viewing a parent/guardian's Payments page, payments made for their students do not display. Only the following types of transactions display for parent/guardians.

- Transactions for food service accounts.

- Payments for fees assigned to the parent/guardian.

- Payments for activities where the parent/guardian is the recipient.

- Purchases made in the School Store where the parent/guardian is the recipient.

Payments made for fees, school store items, activities, and food service accounts can be viewed on the Payments page.

Household Members

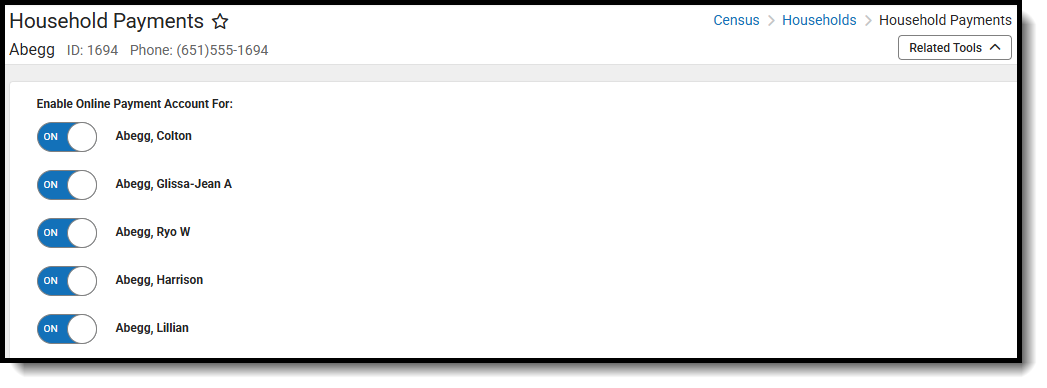

The Payments tool provides the option to remove access to online payments for one or more household members. When this option is set, the household member does not see the Payments area on the portal.

Tool Search: Household Payments

The Household Payments tool provides the option to remove the household member's access to online payments. When this checkbox is marked, the person does not see the Payments area on the portal.

If you disable Online Payments, recurring payments set up by that person are automatically stopped.

Household members will only display on the Payments tab if they have registered a payment method on the Portal.

Household Payments

Household Payments

Manage Online Payments

Staff can check the status of online payments by using the Payments Reporter tool.

Payments Reporter

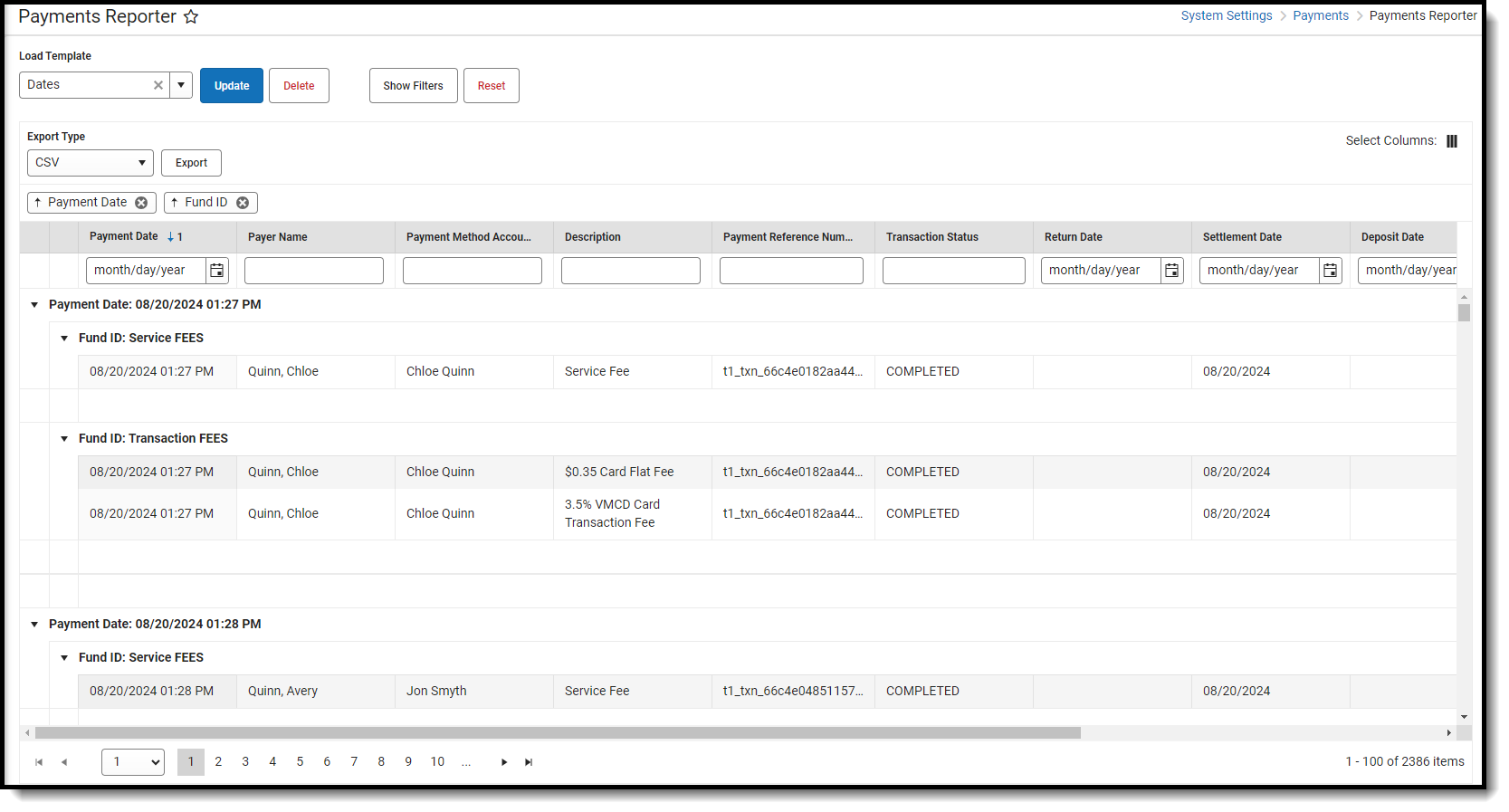

The Payments Reporter tool lets office staff view any payments that were made, perform refunds, export transactions, and modify which column to display in the report.

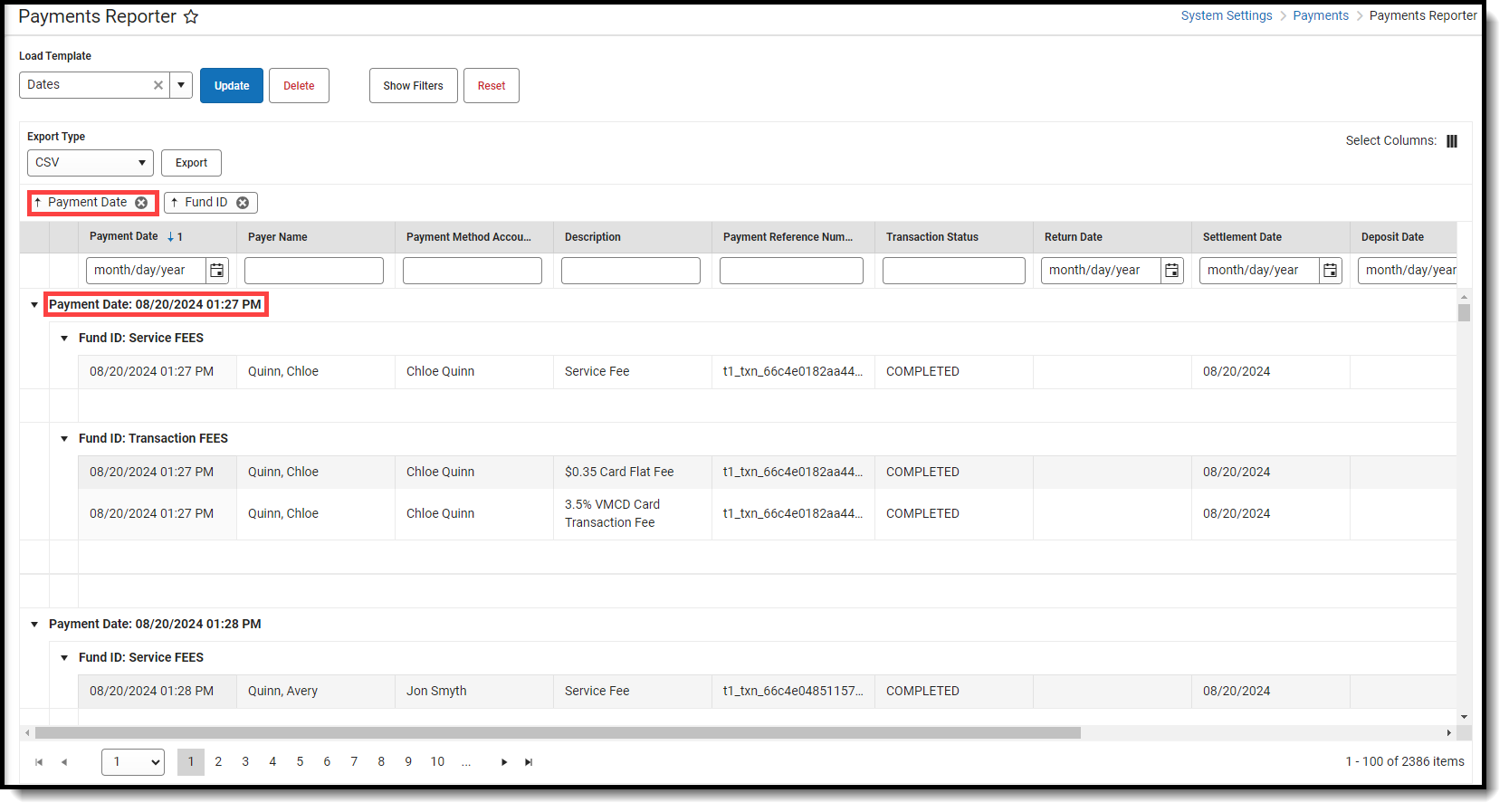

Tool Search: Payments Reporter

The Payments Reporter details all transactions that were completed through the online payment process. With this tool, you can check the status of a specific payment, issue refunds, and revoke transactions.

Important Information about this Tool

- Campus automatically voids all returned transactions. The original transaction appears with the Returned status and the correcting transaction appears with the Return Void status. Transactions may be returned if the account is not valid or has insufficient funds.

- Transaction fees are never refunded.

- Payments with the Transaction Status Resolved can only be refunded if the transaction was resolved by Campus Support. If you need to refund a payment that you manually resolved, contact Campus Support for assistance.

- When a payer makes a purchase for $0.00, Campus assigns a reference number but a Payment Method does not appear in the report. In addition, Service Fees are not applied when the total is $0.00.

- A Deposit Date does not display either unless the zero dollar purchase was purchased with other items for which the payer was charged and the transaction is processed.

- If an E-check fails, it can occur up to 10 business days after settling. If there is a failure, the amount of the E-check is automatically returned.

- Refunds (full or partial) for echecks are not allowed until there is a Settlement Date.

- Refunds for echecks are processed 12 days after the transaction's Payment Date. This ensures funds have cleared before the refund is processed.

- All refunds that are requested between 5:45 p.m. and 6:00 p.m. Eastern Time will not process until 12:00 a.m. the following day. For example, a refund requested at 5:45 p.m. on September 1st will be processed at 12:00 a.m. on September 2nd. This rule applies to all payment types except for echecks which cannot be processed until 12 days after their transaction's Payment Date.

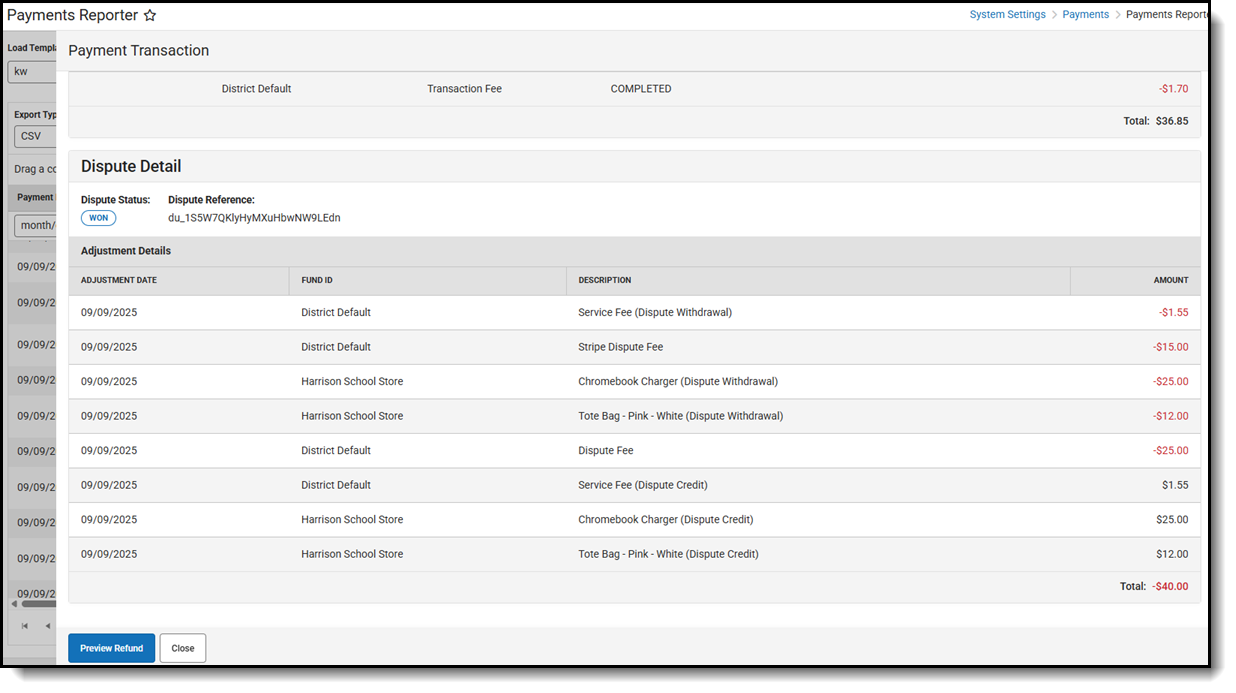

- If a transaction is disputed, a chargeback or dispute fee is assessed. These can be searched for in the Description column as ‘Chargeback’ or “Dispute.’ When clicked, the Payment Transaction history will appear showing all the fees associated with that transaction.

About the Deposit Process

Following a payment, the funds are typically deposited into your bank account within three to four business days. This timeframe includes the settlement of the payment, the request for the deposit, and the bank's processing duration. Please note that this period may vary slightly depending on the timing of the payment and Stripe’s processing schedule.

The deposit process runs daily before 5:45 PM Eastern Time (ET). The deposit job must complete by 6:00 PM Eastern Time (ET); otherwise, the payment platform moves the request date forward one day to ensure the deposit job has enough time to complete.

The deposit process does not run on weekends (Saturday, Sunday) or holidays.

| Step | Description | ||||||

|---|---|---|---|---|---|---|---|

| 1 | Campus determines your district's account balance. When your district is processing payments, any returns/refunds you process are subtracted from your account balance when they occur. At the end of each business day, Campus calculates the balance and then requests a deposit. If your district's account balance is negative, Campus issues a negative deposit. | ||||||

| 2 | After determining the balance, Campus combines transactions with the following statuses into a deposit.

| ||||||

| 3 |

|

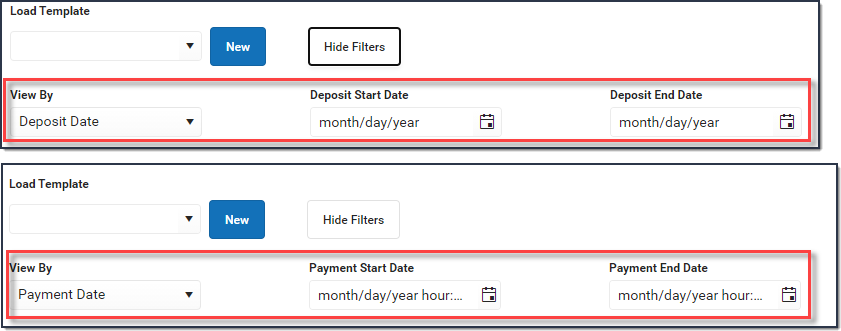

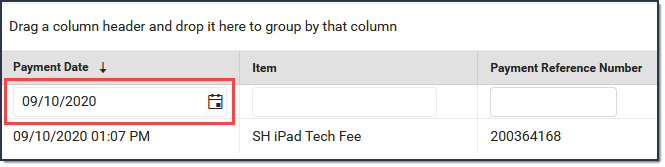

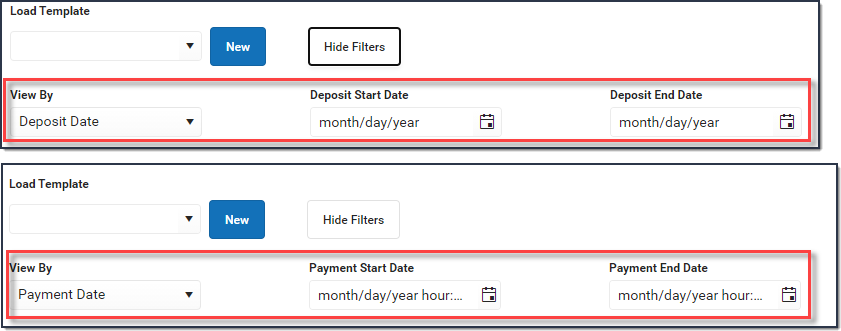

Tips for Searching

- You can search for transactions according to their Payment Date or Deposit Date. Click the Show Filters button, then select the option you want to use in the View By field and enter the appropriate start and end dates.

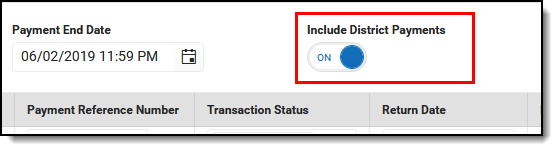

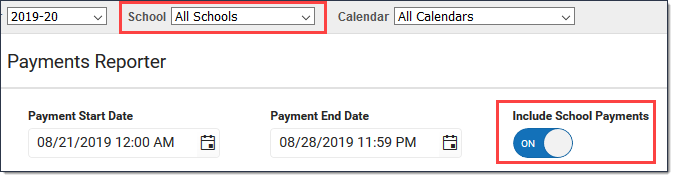

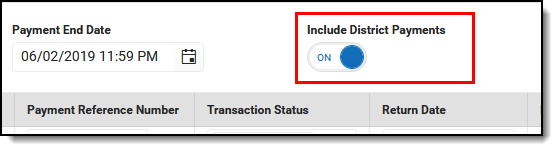

- To include district payments such as Service Fees in your search, click the Show Filters button then toggle Include District Payments to ON. If you want to see payments made to your school only, set the toggle to OFF.

This toggle is only available if your system administrator has assigned the appropriate tool rights.

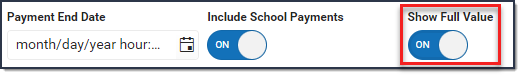

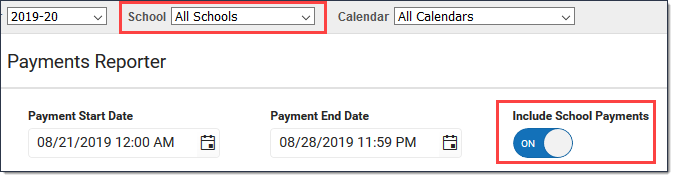

- If you select All Schools in the School dropdown list, only payments made to the district display. However, you can set the Include School Payments toggle to On to include payments from all schools in the district.

- Search results are grouped by Fund ID.

- Select an individual line to see the entire transaction in the Payment Transaction panel.

- Sort results by Deposit Date and Deposit Amount when trying to perform a bank reconciliation.

- You can sort the results by clicking a column heading. Each click changes the data in ascending or descending order.

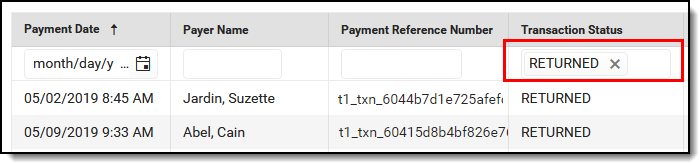

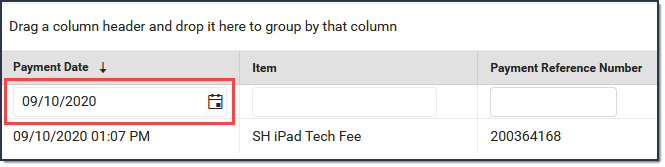

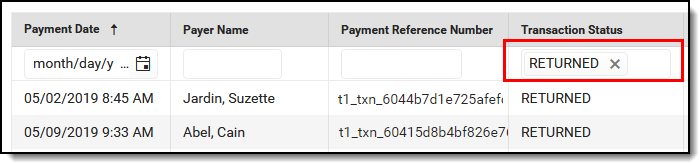

- You can add filters to narrow the report's results. For example, you can find payments that were made on a specific date or Transaction Status.

Transaction Status Descriptions

|

Transaction Status |

Description |

|---|---|

| Completed | A fully completed transaction. |

| Canceled | If a transaction displays this status, you can manually resolve the transaction or contact Campus Support. |

| Exception |

The payment was processed by the payment vendor but not on Campus. If a transaction displays this status, you can manually resolve the transaction or contact Campus Support. |

|

Returned and Return Void |

Campus automatically voids all returned transactions from the payment vendor. The original transaction appears with the Returned status and the correcting transaction appears with the Return Void status. Transactions may be returned if the account is not valid or has insufficient funds. Transactions also appear in these states if the district manually Refunds a Payment. There could be a two to five-day delay in which Campus may have completed the transaction and the payment vendor may need to return it. |

|

Resolved

|

Transactions may be manually resolved by Campus Support or by the district if the transaction was processed but still appears to be in an Exception, Canceled, or Pending Status in the Payments Reporter. |

|

Revoked |

Transactions can be manually revoked by the district if an interruption occurs between the district and the payment vendor where the payment was never processed. This status displays transactions manually revoked by the district within the date range entered on the editor. |

|

Pending |

If a transaction displays this status, you can manually resolve the transaction or contact Campus Support. |

| Processing | If a transaction displays this status, our payment processor is waiting for confirmation from the bank that the transaction has cleared. Once the confirmation is received, the deposit date could be in the past. For example, a fee or refund might show a deposit request date of 4/3 but will stay in pending status until 4/10 then once in completed status the deposit date would be 4/4.

Negative deposits can take 5-7 business days before they have a Deposit State of Completed in Campus.

|

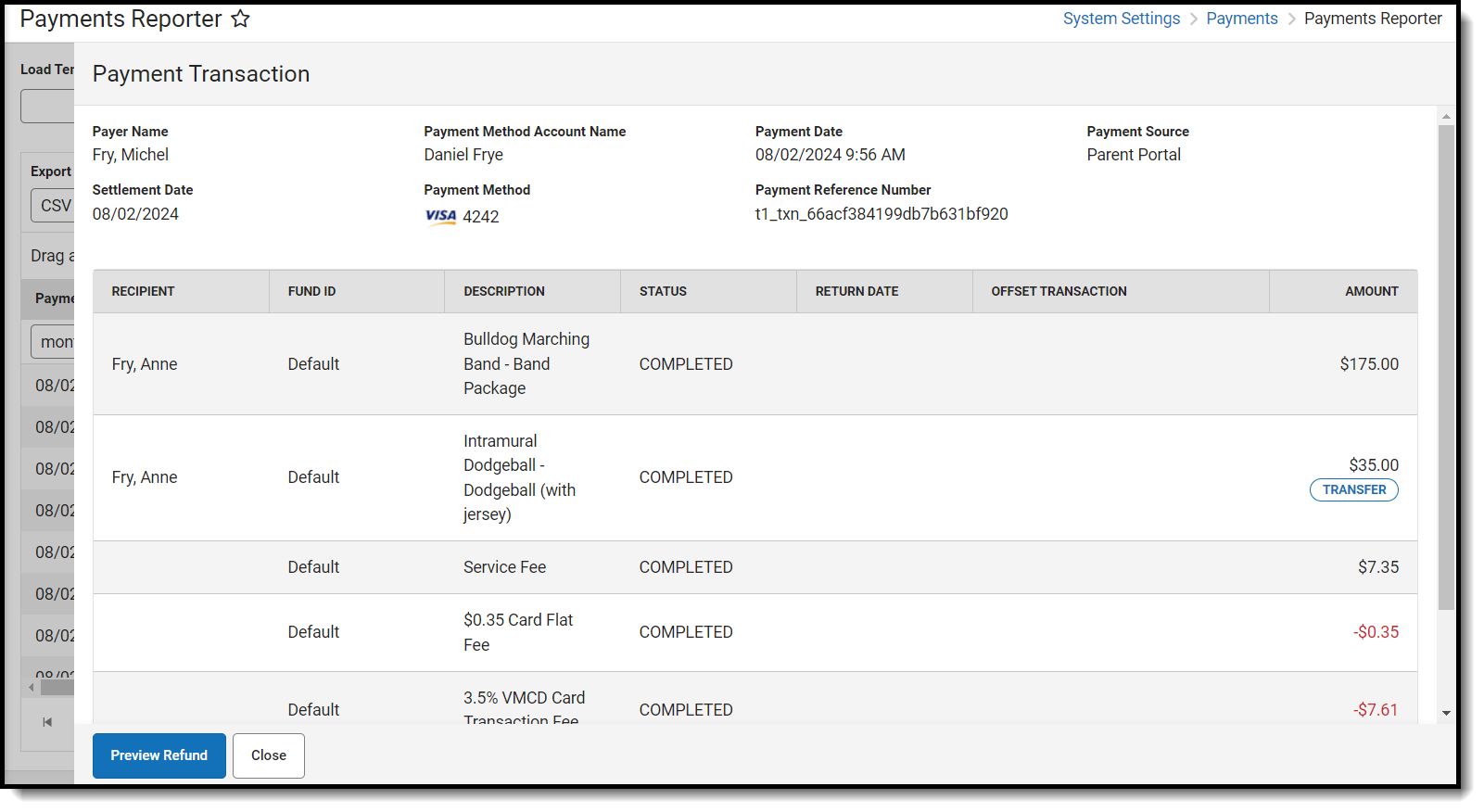

View Details for a Single Transaction

To view details for a single transaction, click the transaction you want to view. The Payment Transaction panel displays details for the transaction.

Since lines on the Payments Reporter are grouped by Fund ID, this is a good method for viewing the entire transaction.

View Disputed Transaction Details in Payment Transaction Panel

When a user clicks on a transaction with a dispute, the information related to that dispute will display within the Dispute Detail.

For Stripe, disputes have been supported since version .2531, and for Payrix since version .2539. Any disputes before these updates will show fees in the Transaction Details section, while disputes after the updates appear in the Dispute Details section.

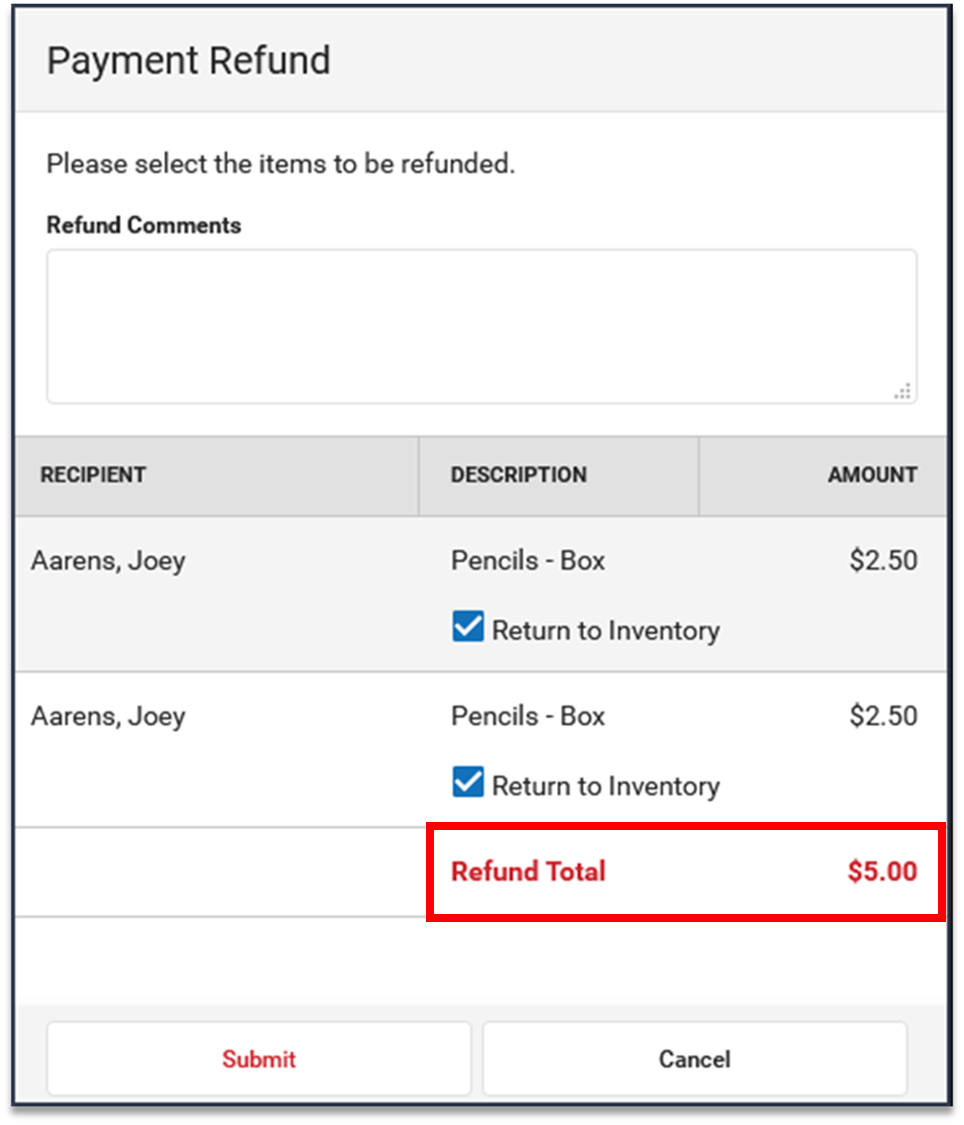

Issue a Full Refund

Tips

- This option is only available if your system administrator has assigned the appropriate tool rights.

- The Transaction Fee cannot be refunded.

- The Service Fee can only be returned if your District has enabled Service Fee refunds in the Payment setup.

- If you do NOT refund Service Fees, the Service Fee stays in a Completed status.

- Refunds for echecks are not allowed until there is a Settlement Date.

- Click the transaction you want to refund.

Result: The Payment Transaction panel displays. - Click the Preview Refund button.

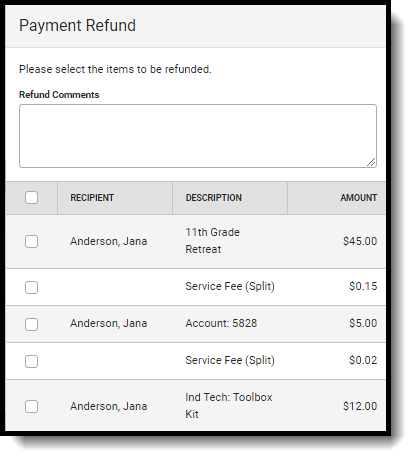

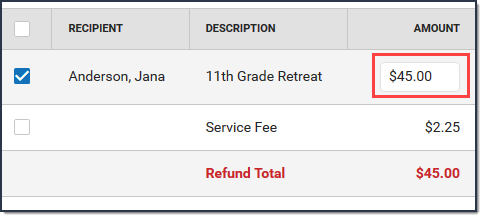

Result: The Payment Refund panel displays. -

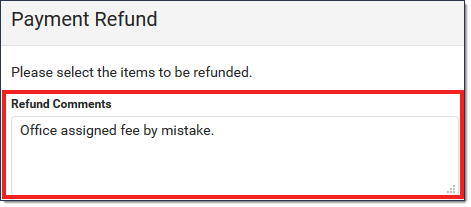

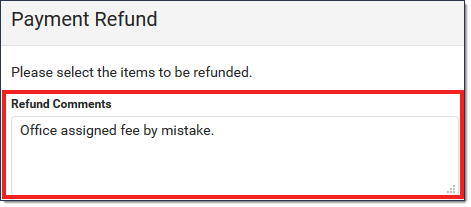

Enter the reason for the refund in the Refund Comments field. (optional)

This comment will display on the offset transaction's details.

-

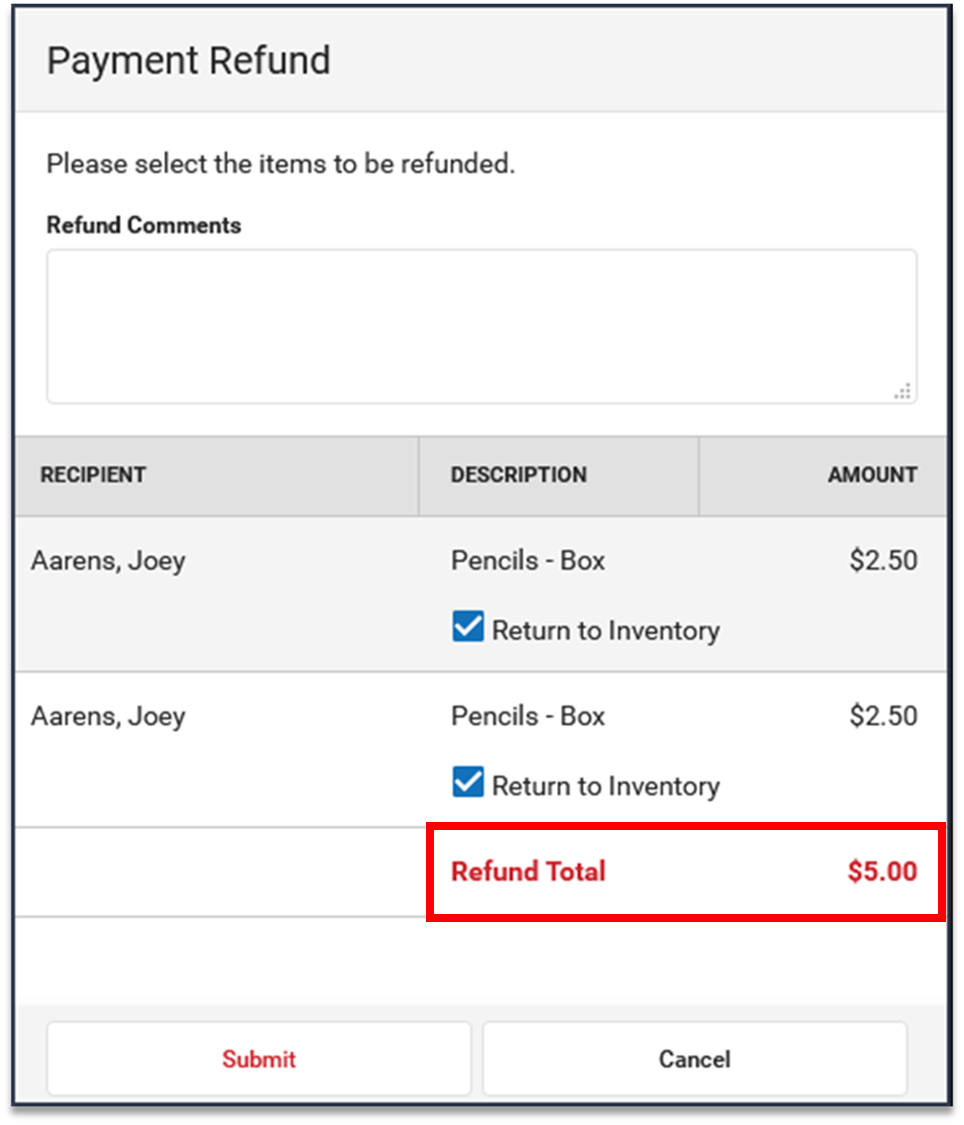

Complete one of the following options. Options that display depend on whether your district allows partial refunds.

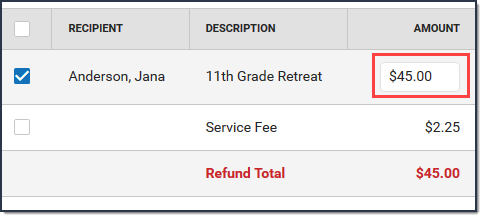

If Partial Refunds... Then... is enabled in Payments Setup (district settings)

- Mark all of the checkboxes.

- Verify the Amount you want to refund.

- If your district uses inventory tracking, verify the Return to Inventory checkbox is marked next to the item(s) you want to return (optional)

- Click Submit.

is not enabled in Payments Setup (district settings)

- The entire amount is refunded; you cannot give partial refunds.

- If your district uses inventory tracking, verify the Return to Inventory checkbox is marked next to the item(s) you want to return (optional)

- Click Submit

Result: A confirmation message displays. - Click OK.

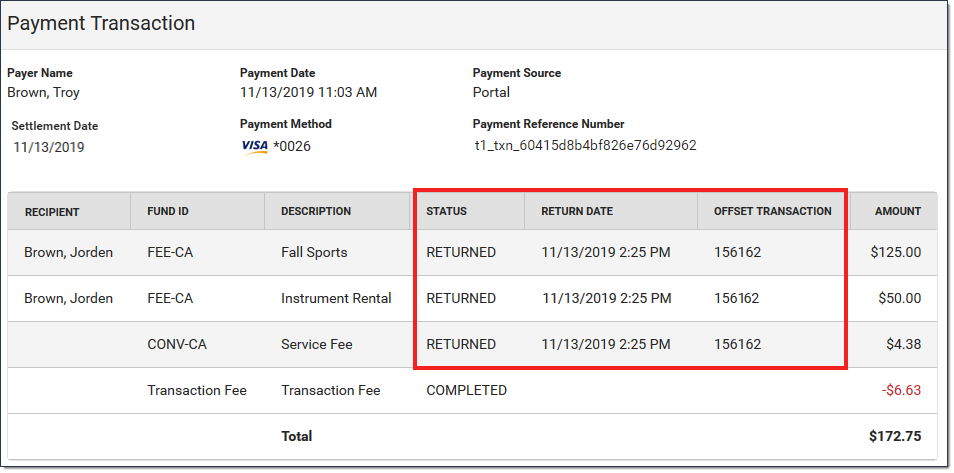

Result

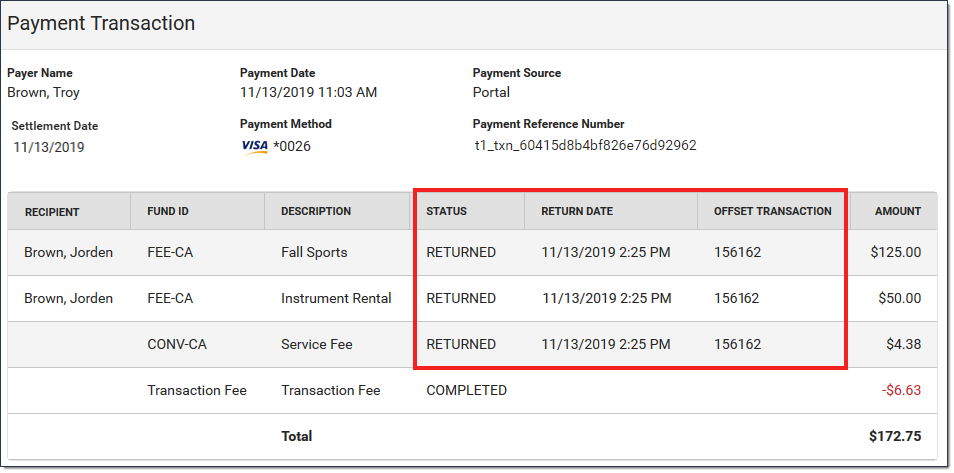

- The Payments Reporter screen displays. Campus updates the original Transaction Status to RETURNED and adds an offset entry with the Status RETURNEDVOID on the refunded lines.

- Campus also updates the original payment transaction's details. After a refund is made, the details include a Return Date and the Offset Transaction Reference Number.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

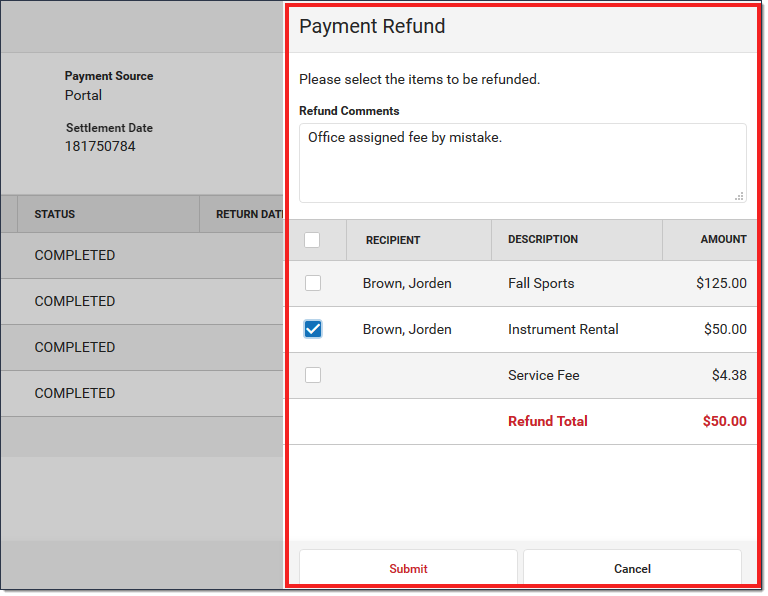

Issue a Partial Refund

Tips

- This option is only available if:

- Your system administrator has assigned the appropriate tool rights.

- Your district has enabled partial refunds in the Payment setup.

- The Transaction Fee cannot be refunded.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

- The Service Fee can only be returned if your District has enabled Service Fee refunds.

- If an item is already partially returned, you cannot make additional refunds on the same item.

- Partial refunds appear in the Payments Reporter with a status of Partial Return and an offset transaction number.

- Refunds for echecks are not allowed until there is a Settlement Date.

- If split fees is enabled, districts may opt to refund only the service fee related to the specific product being returned, rather than the entire service fee if a full refund option is enabled.

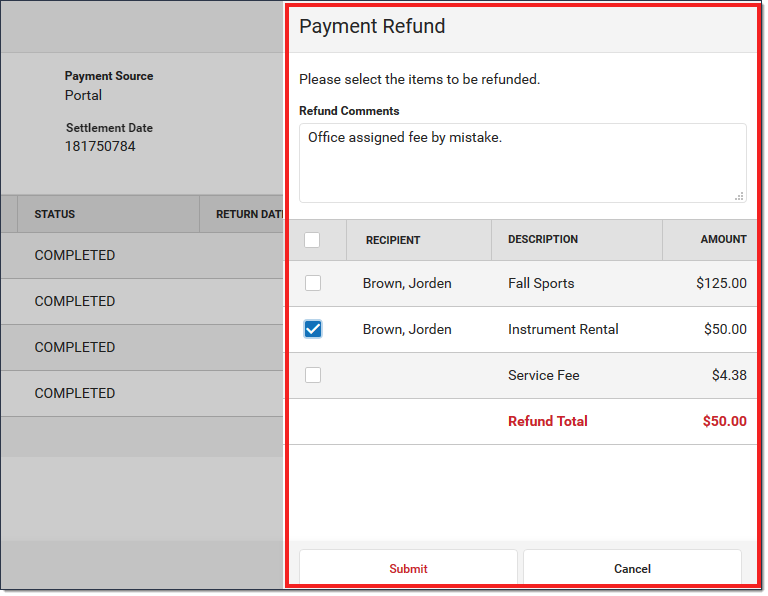

- Click the transaction you want to refund.

Result The Payment Transaction panel displays. - Click the Preview Refund button.

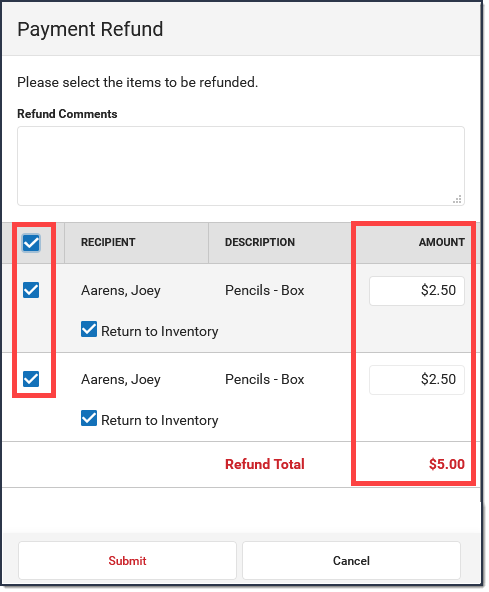

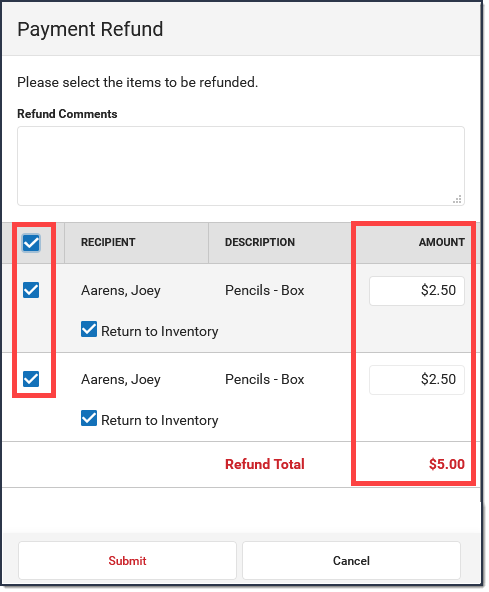

Result The Payment Refund panel displays. Only items eligible for a refund displayed on the screen.

-

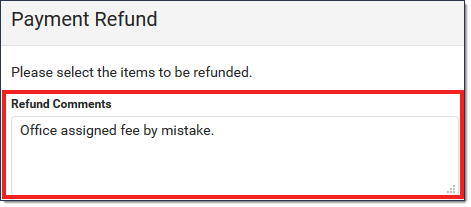

Enter the reason for the refund in the Refund Comments field. (optional)

This comment will display on the offset transaction's details.

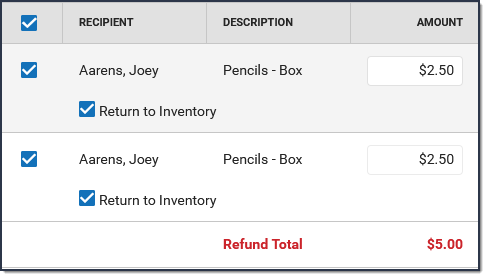

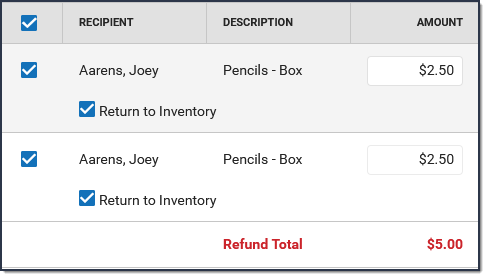

- Mark the checkbox(es) next to the item(s) you want to return.

-

Verify the Amount(s) you to refund.

You can change the amount to be less than the amount that was paid.

- Verify the Return to Inventory checkbox is marked next to the item(s) you want to return to inventory. (optional)

This checkbox only displays if you use inventory tracking and is automatically selected. If you do not want to return an item to inventory, make sure the checkbox is cleared.

- Click Submit.

Result: A confirmation message displays. - Click OK.

Results- The Payments Reporter screen displays. Campus updates the Transaction Status to RETURNED and adds an offset entry with the Status RETURNEDVOID on the refunded lines.

- Campus also updates the payment transaction's details. After a refund is made, the details include a Return Date and the Offset Transaction Reference Number.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

Revoke a Transaction

You can revoke transactions that did not process. Only transactions that are in a Pending, Exception, or Canceled status can be revoked. When revoked, Campus updates the Transaction Status for all lines in the transaction to Revoked and line item balances do not change.- Select the transaction you want to revoke. The Payment Transaction panel displays.

- Click the Revoke button. A confirmation message displays.

- Click OK. The Payments Reporter screen displays. Campus updates the Transaction Status to Revoked and line item balances do not change.

Resolve a Transaction

If the transaction was processed but still appears to be in an Exception, Canceled, or Pending Status in the Payments Reporter, you can manually resolve the transaction. Please note that Resolved transactions may not display a Deposit Date in the Payments Reporter tool.Before you Begin

To manually resolve a transaction in Campus Payments, you must contact Campus Support to get the Payment Reference Number.

- Select the transaction you want to resolve. The Payment Transaction panel displays.

- Enter the Payment Reference Number in the Payment Reference Number field.

- Click the Resolve button. A confirmation message displays.

- Click OK. The Payments Reporter screen displays. Campus updates the Transaction Status to Resolved and payments are posted to the Food Service and Fee Accounts.

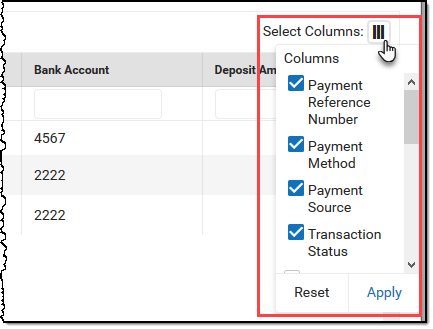

Select Columns to Display

The column selector allows you to choose which columns to hide or display. Click the Select Columns button and mark the checkbox next to the columns you want to display. Clear the checkbox next to the columns you want to hide.

Group Report by Specific Columns (Grouping Options)

The report displays differently based on the grouping options you select. Select the column(s) you want to group together and drag the column(s) to the area above the table. You can select multiple columns and further group the report results.

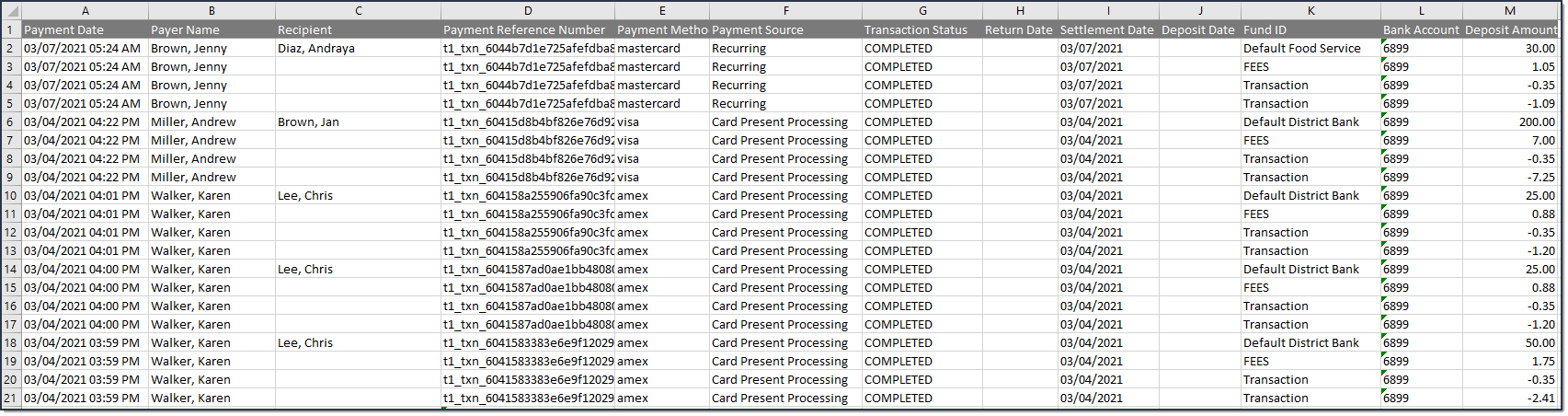

Payments Reporter Column Descriptions

The following columns are available on the Payments Reporter. These columns are available via the column selector and can be grouped, filtered, and saved as templates.

TIP

You can sort the Payments Report by clicking a column heading. Each click changes the data in ascending or descending order. When grouping specific columns, be sure to also sort the column headings to ensure you are viewing the report results in an organized manner.

| Column | Description |

|---|---|

| Payment Date | The date on which the payment was made. |

| Payer Name | The name of the person who made the payment. This column will only show a name if the payer is a logged-in Infinite Campus user. |

| Payment Method Account Name | If a name is entered in a payment method, it will be displayed in this field. |

| Recipient | The person receiving items purchased in the School Store or the student who was registered for an activity.

If an item was purchased and paid through the Campus Mobile Payments app, the student's name appears IF the student number was entered at the time of the purchase. |

| Description | A description of the fee.

If the 'Split Transaction and Service Fees' checkbox has been enabled within the Payments Setup Settings, any transaction or service fee involving a split will be designated with '(Split)' in its description.

|

| Payment Reference Number | This number is automatically generated by the payments platform and is a unique identifier for a specific transaction. |

| Payment Method | Indicates what was used to make the payment; e.g., type of credit card or eCheck. If eCheck is used, it will indicate if it was from checking or savings. |

| Card Entry Type | Shows whether a credit/debit card payment was typed in manually, swiped, or processed through the Campus Mobile Payments app using a chip insert or tap (EMV). If the payment method was not a credit or debit card, this column will appear blank. |

| Payment Source | Identifies where the transaction occurred.

|

| Transaction Status | The current state of the transaction. See the Transaction Status topic for more information.

|

| Dispute Status | Displays the status for any payment currently or previously involved in a dispute.

If you have any questions regarding a Dispute Status, please contact Support. |

| Return Date | After a refund is made, the details include this Return Date and the Offset Transaction Reference Number. |

| Settlement Date | The date on which the payment is finalized and eligible to be deposited. |

| Deposit Date | The date when the payment platform deposits the money into the bank accounts. |

| Deposit Request Date | The date when Campus requested payments to be disbursed to the bank accounts. |

| Deposit Request Reference | The ID the payment platform sends to Campus when Campus requests a disbursement. |

| Fund ID | The unique identifier for the Fund Account. Fund ID is unique and the same Fund ID cannot be used at different schools. |

| Fund Description | A description of the Fund Account. |

| Bank Account | The bank account associated with the Fund ID. |

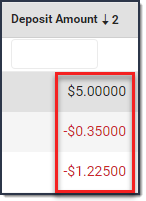

| Deposit Amount | The specific amount of money that constitutes the deposit.

Tip: Turn the Show Full Value toggle to ON to see the Deposit Amount go to 5 decimal places.

|

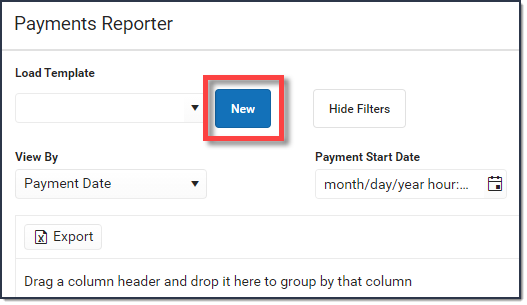

Create and Manage Templates

Templates allow you to save a custom view of the Payments Reporter and use it again later. You can choose specific columns to display, group them in a useful way, filter data in each column, and save your selections as a template. You can create multiple templates as well as update or delete templates at any time.

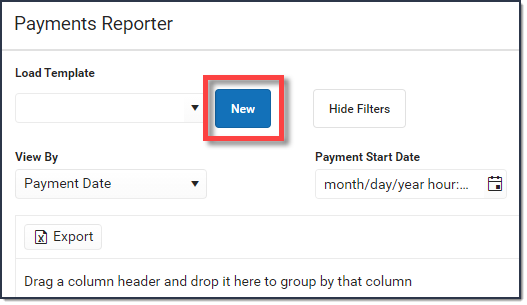

Create a New Template

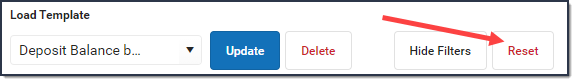

If there are existing templates, click the Reset button before you begin.

- Use the Select Columns tool to choose the column(s) you want to display then drag the column(s) you want to group together to the area above the table.

- Click the Show Filters button and enter any filter data you want to use. (Optional)

- Further narrow down report results by using the filters in each column. (Optional)

- Click the New button (next to the Load Template dropdown list).

Result: The Create Template panel displays.

Result: The Create Template panel displays. - Enter the Template Name then click Save.

Result: The new template displays in the Load Template dropdown list.

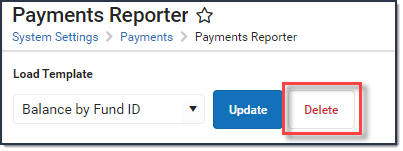

Delete a Template

To delete a template, select the template you want to delete in the Load Template dropdown list then click the Delete button.

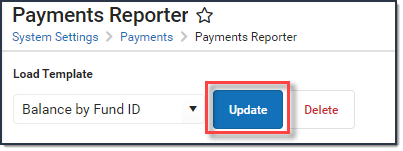

Update a Template

To update a template, select the template you want to update in the Load Template dropdown list. Make any necessary changes then click the Update button to save your changes.

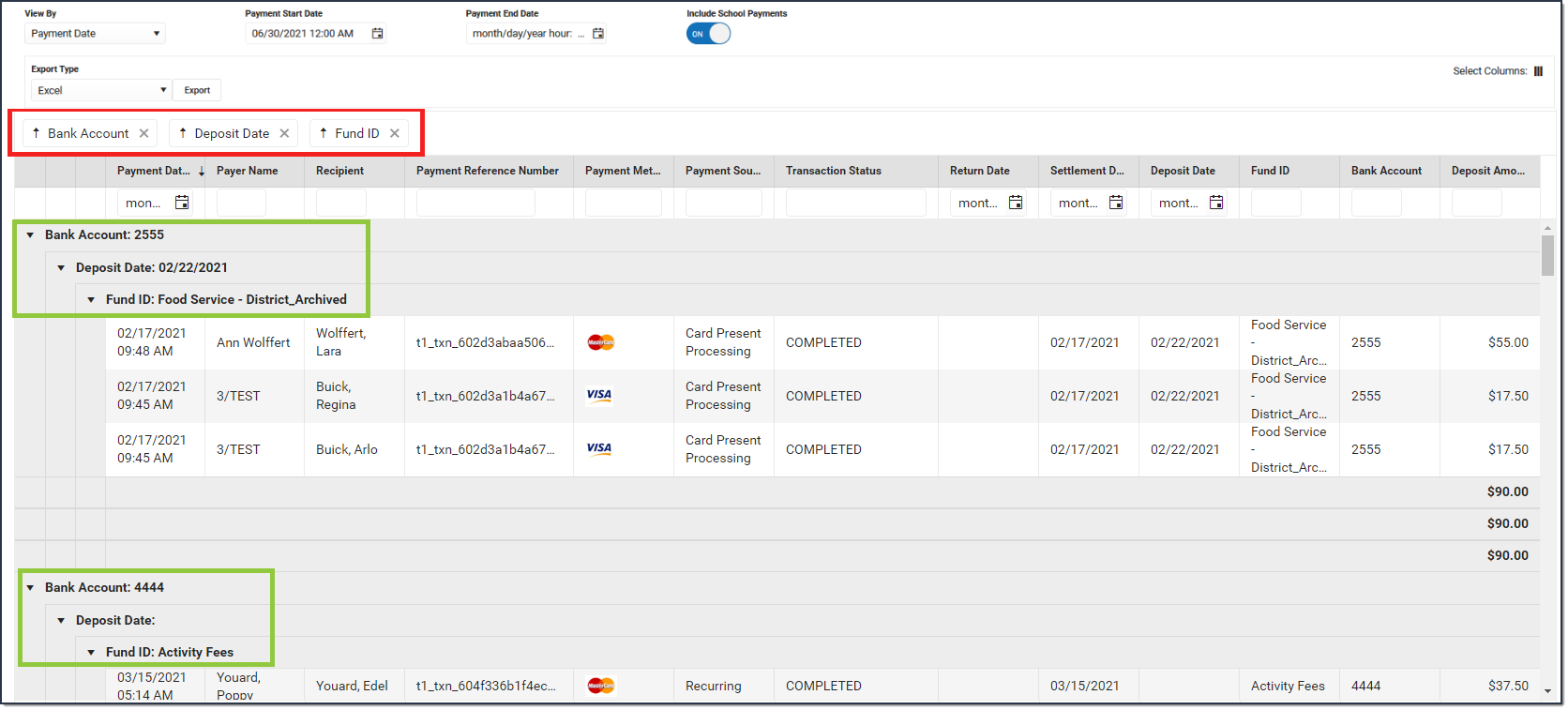

Identify Deposit Balance by Fund ID

The report displays differently based on the grouping options you select. Select the column(s) you want to group together and drag the column(s) to the area above the table. To identify the balance by Fund ID, group columns in the following order:

- Bank Account

- Deposit Date

- Fund ID

Export the Report

You can export the report to CSV or PDF format. To export the report, select the format you want from the Export Type dropdown list then click the Export button.

If you do not limit the report results using the Payment Start Date and/or the Payment End Date, the export will be limited to the last 60 days.

Previous Version

Payments Reporter [.2435 - .2527]

Payments Reporter [.2347-.2431]

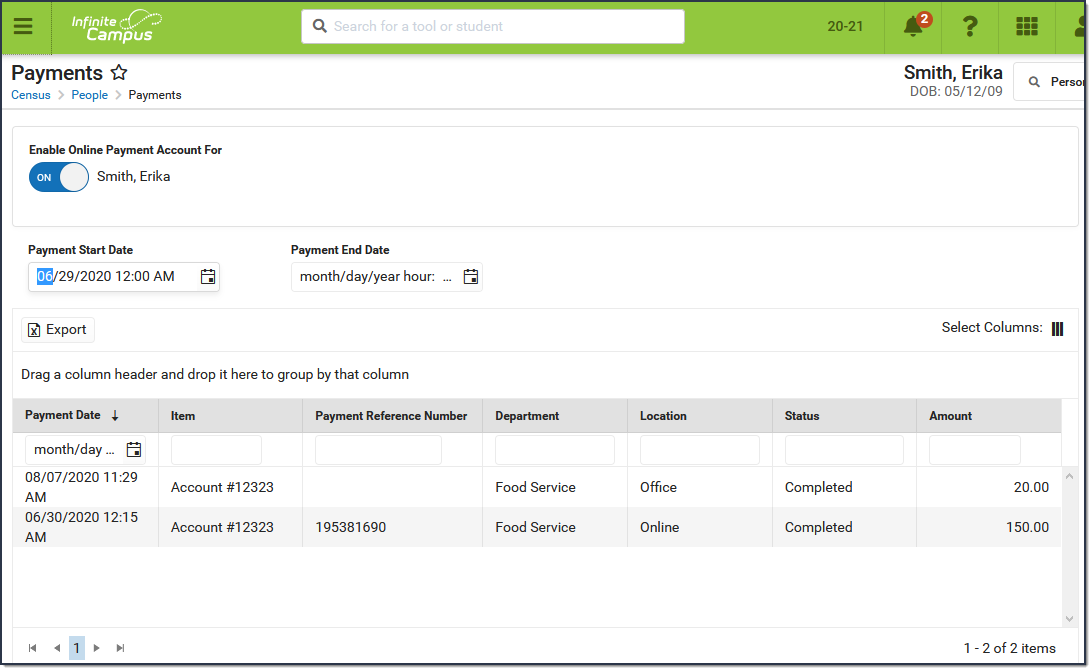

Payments Tool

The Census > People > Payments tool provides details of all transactions processed online, at a POS terminal, or in the office for an individual student. With this tool, you can check the status of payments based on a date range.

Tool Search: Payments

The Payments tool provides a summary of online payments, Food Service deposits, School Store purchases, and office payments made for an individual person. The Payments tool is also where you can enable or disable a person's access to online payments.

| What can I do? |

|---|

| Enable or Disable Access to Online Payments Review Payments |

Enable or Disable Access to Online Payments

- When this toggle is ON, the person can use My Cart to make payments.

- When this toggle is OFF, the person can NOT use My Cart to make payments. When you set this toggle to OFF, recurring payments set up by this person are automatically stopped.

By default, users may make payments for any Fee regardless of the calendar in which the Fee was assigned. This also means that payments can be made for students who do not have an active enrollment.

Review Payments

The Payments tool allows you to review details about transactions that were completed through the online payment process, a food service terminal, or in the office.

- You can sort the results by clicking a column heading. Each click changes the data in ascending or descending order.

- You can add filters to narrow the report's results. For example, you can find payments that were made on a specific date.

- The column selector allows you to choose which columns to hide or display. Click the

button and mark the checkbox next to the columns you want to display. Clear the checkbox next to columns you want to hide.

button and mark the checkbox next to the columns you want to display. Clear the checkbox next to columns you want to hide. - The Amount column is only visible if you are assigned the Show Payment Amounts tool right.

If you are viewing a parent/guardian's Payments page, payments made for their students do not display. Only the following types of transactions display for parent/guardians.

- Transactions for food service accounts.

- Payments for fees assigned to the parent/guardian.

- Payments for activities where the parent/guardian is the recipient.

- Purchases made in the School Store where the parent/guardian is the recipient.

Payments made for fees, school store items, activities, and food service accounts can be viewed on the Payments page.

Result: The Create Template panel displays.

Result: The Create Template panel displays.